Reflecting investor and stakeholder values in digital assets is important and not the same as for traditional assets.

For a PDF version, please click here.

Introduction

As institutional investor interest in digital assets has increased, the mandates and standards that capital allocators need to consider before entering into a new asset class are becoming more important. One of these mandates is an Environmental, Social, and Governance (ESG) assessment.

In this post, Digital Asset Research (DAR) shares some of the opportunities and challenges in applying an ESG framework to digital assets, as well as a high-level view of our work in this area. Since 2017, DAR has provided rigorous analysis of crypto assets for institutional clients. As the space has matured, the need for value-driven metrics has increased and in 2023 firms are seeking meaningful crypto asset ESG evaluation factors and scoring.

What is ESG and Why Is It Important?

The Environmental, Social, and Governance terms in ESG refer to three critical pillars that measure the sustainability, stakeholder impact, and degree of responsibility of an asset and the firm behind the asset.

The modern concept of ESG started about 20 years ago as asset owners’ became concerned that their portfolios may contain investments not aligned with their values. Using ESG measures to screen investments can incentivize capital-seeking firms to embrace and report on those values, and provide asset owners with comfort that they are encouraging aligned values. As a result, many investment managers have embraced those ESG mandates to reflect asset owners’ view of the world and win their business.

To date, digital assets, including crypto assets, have not had a meaningful ESG discussion beyond consideration of energy consumption, particularly around the Proof-of-Work vs Proof-of-Stake dialogue. The ESG conversation needs to move forward as the “S” and “G” pillars in crypto assets matter significantly, especially due to the asset class’ open-source, global, and permissionless nature.

ESG Differences in Traditional Finance vs Crypto

In traditional finance, ESG generally refers to how a company or an organization’s business practices impact various sustainability and ethical issues. This includes climate impact, stakeholder treatment, corporate transparency and responsibility, and many other related topics. These measures are assessed by looking at reporting by the company and various auditors on factors like emissions targets, labor policies, supply chain oversight, corporate governance structure, external audits, regulatory compliance, and more.

In crypto, the goal of an ESG scoring framework is the same, but a uniquely comprehensive understanding of how crypto assets work is required and a different approach to information gathering is needed. This is because the organizational features of crypto assets do not match traditional assets, such as equities. Typically, in crypto, there is not a central company to do reporting, the issues that may impact stakeholders are different, and approaches to governance are unique.

Crypto assets live on top of permissionless blockchain technology. At its core, permissionless blockchains allow for any entity, from anywhere in the world, to create products and organizations on top of the blockchain. The results of this design often lead to a fairly decentralized organizational structure without a clear centralized authority to dictate decisions on conventional ESG measures such as labor practices, financial transparency, and others.

Additionally, the health of a crypto asset and the blockchain network that it lives on often depends on its user base and community engagement with the network, often in the form of decentralized use, community contribution, and governance. This is in contrast to most traditional assets whose health depends on effective management and adoption by customers who have little or no governance role.

Let’s take a closer look at how ESG measures compare across traditional finance and crypto assets.

| Environmental | Social | Governance | |

|---|---|---|---|

| Traditional Finance | Includes how a company protects or interacts with the environment and related policies | Includes how a company interacts with employees, suppliers, customers, and other stakeholders | Includes a company’s leadership, incentives, internal controls, audits, and shareholder rights |

| Crypto Assets | Includes the project’s environmental impact | Includes the strength and other aspects of the project’s network and communities | Includes the distribution, quality, and durability of the token’s governance |

By taking into account the differences between traditional and crypto assets, DAR has identified metrics that can help evaluate crypto ESG values.

In evaluating ESG for crypto assets, one difference we propose is the evaluation of a 4th pillar: Network Health (“N”). This pillar evaluates the diversity and robustness of the network’s users, codebase developers, and on-chain transactions. Scores for Network Health can be treated on a standalone basis as a separate pillar or can be rolled into a consolidated overall Social score.

3 ESG Concerns Around Crypto Assets

High Energy Consumption

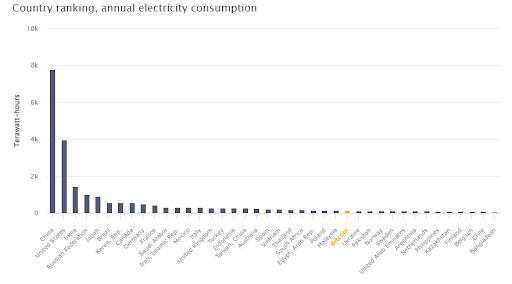

One of the primary ESG concerns around crypto assets, especially Bitcoin, is high energy consumption. The “mining” process used to create new coins and verify blockchain transactions as part of Bitcoin’s Proof-of-Work consensus mechanism involves solving complex mathematical problems that require substantial computational power, which in turn, consumes a large amount of energy. According to published estimates, Bitcoin’s energy consumption rivals that of some countries. While there are debates within the crypto community of whether this is acceptable given the robust history of Proof-of-Work, understanding the level of energy usage and relative use of clean energy is a measure important to investors who may prefer assets that use less energy-intensive Proof-of-Stake consensus mechanisms. Scoring and reporting can provide investors with transparency to make decisions around acceptable crypto asset energy usage.

Source: https://ccaf.io/cbnsi/cbeci/comparisons

Illicit Activity

In addition to environmental concerns, there are social concerns associated with the use of crypto assets. One of the most common examples is the use case of privacy coins, which offer greater anonymity to users. Privacy coins have historically been associated in the mind of the public with illicit activities, such as money laundering and illegal trade. While this does not represent all use cases or users of privacy coins, these concerns cannot be ignored if crypto as an asset class is to be taken seriously by institutional capital allocators. The ability to trace transactions, which does exist in the majority of popular public blockchains including the Bitcoin and Ethereum blockchains, is a key requirement in modern financial systems to limit illegal activities. The lack of transparency in certain crypto assets and blockchain networks has raised ESG-related concerns.

Lack of Project Transparency

Ironically, the lack of transparency amongst newer crypto projects has been a critical governance issue despite blockchain’s technology transparency ethos. Many projects conducted their token launch without sufficient disclosures and transparency, which may have resulted in unfair information asymmetry amongst market participants. Insiders with direct access to the team behind the crypto assets could have an unfair advantage by knowing about critical events that can affect the underlying value of the assets. This lack of transparency makes it difficult for investors to evaluate these assets properly and raises concerns about investor protection, fraud, and market abuse. While the technology underpinning cryptocurrencies is heralded for its potential to drive transparency and reduce corruption, the current reality is that many projects do not fully deliver on this promise.

ESGN: An ESG Framework for Crypto

Across the 4 pillars, DAR has identified over 250 potential ESGN measures that are designed for assessing crypto assets. Some of those measures are the same as ESG factors for traditional assets and others are reflective of the different risks associated with crypto assets.

Environmental

The Environmental pillar is pivotal when evaluating crypto assets due to their significant energy concerns. Primarily driven by the “mining” process, critics often argue that crypto assets like Bitcoin consume vast amounts of electricity.

The consensus mechanism that powers a crypto asset and/or its network dramatically influences its energy consumption, with Proof-of-Work protocols typically being much more energy-intensive than alternatives like Proof-of-Stake.

Carbon offsets and climate initiatives such as clean energy use are also gaining attention in the crypto world as mechanisms to balance their environmental impact. Transaction efficiency is another critical element when considering an asset’s environmental impact. In general, the more efficient a blockchain network is, the lower its energy use per economic transaction can be.

Finally, a token’s use case can have environmental implications. Some tokens are being developed specifically to support environmental initiatives, such as tracking carbon credits or incentivizing environmentally-friendly behavior, or tracking climate treaty compliance. All of these considerations highlight the importance of environmental scrutiny in the crypto asset space.

Social

The Social factor plays an equally crucial role in evaluating crypto assets. The assets’ user bases and developer communities form the backbone of these tokens due to their decentralized nature. A vibrant, active, and diverse developer community is an important signal of a healthy and innovative ecosystem. Similarly, an active user base is essential for the token’s functionality and stability, while the overall ecosystem – including exchanges, wallets, and businesses accepting the currency – indicates the asset’s acceptance and utility.

Consistent and clear communication from the team behind an asset is also important to maintain trust and understanding with the community. Transparent communication surrounding the distribution of token holdings also provides insight into potential social/community-related risks. For instance, a crypto asset is seen as more equitable when it displays a more decentralized token distribution and has well-defined treasury capital usage.

Lastly, some crypto projects also plan to use tokens for social impacts, such as financial inclusion projects, disaster response, or supporting non-profit organizations. These social considerations provide a lens through which to understand a crypto asset’s broader societal impacts.

Governance

The governance mechanisms underpinning crypto assets are unique. Unlike in equities, good crypto asset governance does not necessarily equate to a strong centralized management structure. Instead, strong crypto governance often refers to assets with a more distributed power structure that maintains robust operational practices.

For instance, insider ownership is significant when considering the Governance pillar as it can influence the direction of a project and potentially lead to the centralization of power. Similarly, the distribution of power amongst network participants, such as miners or validators, is a critical factor to consider. A broad and diverse distribution of ownership often implies a more secure and decentralized network, as this type of crypto asset is less subject to centralization risk.

For application layer tokens with governance dynamics, the rules that outline how tokenholders can participate in decision-making processes are essential for understanding the asset’s level of decentralization and promoting a more equitable distribution of power. Together, these governance considerations shape the integrity, resilience, and long-term sustainability of a crypto asset.

Other key governance factors include transparency around tokenomics and the project’s treasury operations, as well as the presence of code audits and a sufficient strategy to navigate ongoing regulatory developments.

Network

The health of the network itself is uniquely important in evaluating crypto assets and we have added Network Health (“N”) as a fourth evaluation pillar alongside E, S, and G. To assess “N”, we review statistical measures that show levels of robustness and decentralization.

An asset’s community of developers may build great code and the supporting team may be strong, but if the network is not robust, owners of the asset run a higher risk that the network will collapse. To be robust, a network should see activity that indicates network participants are highly decentralized (not related) and that network use and decentralization is increasing.

| Pillar | Top Assessment Measures |

|---|---|

| Environmental | • Energy use • Consensus mechanism • Carbon offsets and climate initiatives • Transaction efficiency • Use of the token for environmental impact |

| Social | • Developer communities • Active user base and ecosystem • Consistent communication • Token holdings distribution • Use of the token for social impact |

| Governance | • Insider ownership and control • Miners and validators distribution • Tokenomics and treasury transparency • Audit and regulatory action • Token governance dynamics |

| Network | • Codebase quality • Developer diversity • Cost to join the network • Network participation • Measures of decentralization |

How An ESGN Scoring Framework Helps Crypto Assets

A robust ESGN scoring framework for crypto assets paves the way for institutional investors to become more comfortable with their decision-making prior to investing and signals the maturity of the asset class. A comprehensive assessment of crypto assets’ Environmental, Social, Network, and Governance measures is more critical than ever due to the relatively new nature of the asset class and its unique features.

DAR’s ESGN scoring framework provides the clarity necessary to help mitigate risks associated with high energy consumption, illicit activities, and opaque operations, thus aligning the crypto space with standards that are widely accepted across other asset classes. An asset’s scores could also attract ESG-conscious investors as institutions are more likely to engage with assets that align with their ESG mandates, further catalyzing crypto’s institutional adoption.

For more information on our ESNG scoring methodology and offerings, contact us at info@digitalassetresearch.com

Disclaimer