For a PDF version of this primer, please click here.

This primer highlights conversations related to Proof-of-Stake (PoS) consensus mechanisms, as well as staking-related developments in the broader blockchain and cryptocurrency sector.

The primer also includes details on staking for three assets, including notable assets such as Cardano (ADA), Ethereum (ETH), and Solana (SOL).

Our report is compiled from Digital Asset Research’s (DAR’s) data sources, public sources, media reports, and press releases, and, while wide-ranging, covers only representative initiatives related to staking in the digital asset space.

Introduction

Blockchain technology has evolved significantly since the introduction of Bitcoin in 2009. The foundational premise of blockchain is the use of a decentralized ledger that enables multiple participants to reach a consensus on the outcome of events, such as transactions, without the need to rely on centralized intermediaries.

To ensure participants agree on the state of the network, blockchains use a “consensus mechanism”. Consensus mechanisms are processes followed to achieve agreement across a decentralized network while maintaining trust and security.

Bitcoin utilizes a Proof-of-Work (PoW) consensus mechanism, which relies on computational power to reach consensus, validate transactions, and secure the network. As the blockchain industry has matured, new types of consensus mechanisms emerged. The most popular consensus mechanism in recent years is Proof-of-Stake (PoS), which relies on a process called staking.

What is Proof-of-Stake?

The concept of PoS was first introduced in 2011 by Sunny King and Scott Nadal in their Peercoin whitepaper. It emerged as an alternative to the energy-intensive PoW model, which requires miners to solve complex cryptographic problems to validate transactions and secure the network.

To solve these complex problems, PoW miners need to use massive computational power. Over time, many industry participants argue that the capital expenditure and operational costs of mining Bitcoin have become a barrier for smaller players, leading to the centralization of mining pools. Additionally, PoW as a consensus mechanism also has a challenge in scaling up its transaction throughput. As a result, the majority of newer blockchain networks have decided to adopt a different consensus mechanism than PoW, with PoS being one of the most popular alternatives.

In PoS networks, miners are commonly called “validators”. Validators are responsible for the same actions that miners do in PoW networks, such as validating transactions and securing the network. However, instead of deploying computational power, validators are required to “stake” the native token associated with the underlying blockchain network that they are participating in.

How Staking Works

There are numerous implementations of PoS. At its core, PoS validators are chosen to create new blocks and validate transactions based on the number of tokens they hold and are willing to “stake” as collateral. Validators are then incentivized to do the right thing as their staked tokens can be forfeited if they act maliciously or harm the network.

Instead of risking capital in the form of mining rigs and operational costs as they would in a PoW blockchain, validators in a PoS network risk their capital in the form of the native tokens associated with the underlying blockchain.

In PoW, miners risk USD-denominated capital through operational, electricity, and hardware costs, which does not incentivize miners to keep their mining rewards. PoW miners often sell their rewards to cover expenses or to purchase more mining rigs to scale up their operations and capture market share.

In PoS, validators stake the native token of the blockchain they are validating instead of purchasing mining rigs. As a result, validators are not risking USD-denominated assets. This aligns incentives between the validators and the blockchain network while reducing the need to sell their rewards to cover expenses. The goal is to create a compounding loop that increases their market share (and consequently their rewards) if validators decide to stake their rewards.

Proponents of PoS argue that this compounding loop contributes to the safety of the consensus mechanism as validators have a vested interest in the long-term health of the network due to their staked tokens. This makes it expensive and unprofitable for attackers to compromise the network.

On the other side, those against PoS argue that implementations of PoS often add a layer of centralization. For instance, Delegated Proof-of-Stake is a version of PoS whereby stakers select delegates to validate the network, outsourcing the required work to a third-party for a small fee taken from earned staking rewards.

Yield & Energy Efficiency

There are also two additional benefits of PoS related to yield and energy efficiency.

Yield

The rewards generated from PoS networks are a substantial source of yield. Yield generated from staking and participating in a blockchain network is equivalent to a stock dividend that is automatically reinvested in the underlying equity. By contrast, in PoW systems, there is no pathway for an asset owner to receive more of the same asset by participating in the network; PoW assets such as Bitcoin require asset owners to lend out the asset in order to receive yield.

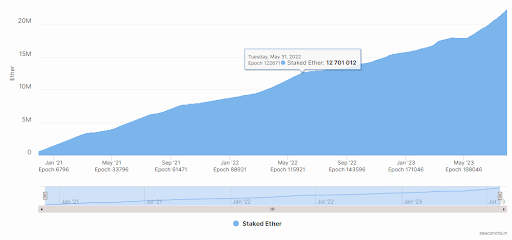

In a nutshell, yield is utilized to incentivize users to help secure the network by depositing their tokens as collateral. Thus far, the growth of assets being staked has shown that market participants are willing to deposit their capital in return for yield, helping secure the underlying network in the process.

Source: beaconcha.in

Offering staking rewards allows for a more direct means of earning as compared to a PoW blockchain, where mining requires significantly more expertise and resources. A PoS-based consensus mechanism could potentially benefit a wider range of users.

It is important to note that as the blockchain matures, yields generated per user decrease, although the rate of depreciation for staking rewards on each blockchain differs based on the tokenomics designed for each protocol. The rationale behind this diminishing yield is to promote decentralization by preventing a concentration of power within the network. If rewards remained constant or increased proportionally with staked tokens, it could enable larger holders or entities with substantial resources to amass a significant number of tokens and control block validation. This scenario could jeopardize the network’s security and overall decentralization.

Energy Efficiency

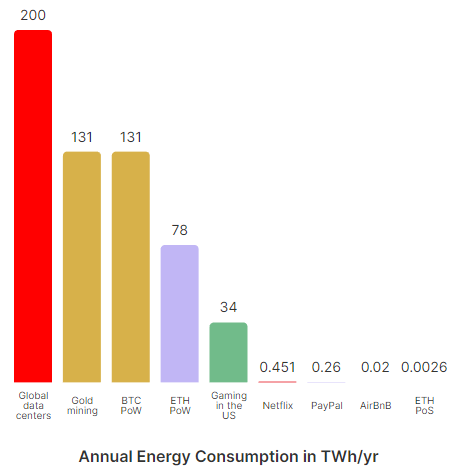

PoW requires computational power for miners to effectively do their job. At a large enough scale, the energy consumed can be extremely significant. As the second largest digital asset by market capitalization, Ethereum was using 5.13 gigawatts on a continuing basis with PoW, or roughly equivalent to the same amount of energy consumed by 2,100 American homes. After transitioning to PoS, Ethereum is using 30,000x less energy.

Ethereum.org posted data on Ethereum’s energy usage compared to estimates for various industries:

| Annualized energy consumption (TWh) | Comparison to PoS Ethereum | Source | |

|---|---|---|---|

| Gold mining | 240 | 92,000x | Source |

| Gold mining | 130 | 50,000x | Source |

| Bitcoin | 130 | 50,000x | Source |

| Bitcoin | 100 | 38,000x | Source |

| YouTube | 244 | 94,000x | Source |

| Global data centers | 200 | 78,000x | Source |

| Netflix | 0.45 | 175x | Source |

| Netflix | 94 | 36,000x | Source |

| PayPal | 0.26 | 100x | Source |

| Gaming in USA | 34 | 13,000x | Source |

| PoW Ethereum | 78 | 30,000x | Source |

| PoS Ethereum | 0.0026 | 1x | Source |

Source: Ethereum.org

PoS Adoption

Today, many of the top digital assets by market capitalization are using PoS consensus mechanisms. Ethereum, which has more than $27 billion in Total Value Locked across its DeFi ecosystem, transitioned to PoS in September 2022. Additionally, 11 out of the top 25 digital assets by market capitalization are using PoS. See the table below for details.

| Asset | Market Cap Rank | Consensus Mechanism |

|---|---|---|

| Ethereum (ETH) | 2 | Proof-of-Stake |

| BNB (BNB) | 4 | Proof-of-Stake |

| Cardano (ADA) | 9 | Proof-of-Stake |

| Solana (SOL) | 10 | Proof-of-Stake |

| TRON (TRX) | 11 | Proof-of-Stake |

| Polkadot (DOT) | 12 | Proof-of-Stake |

| Polygon (MATIC) | 13 | Proof-of-Stake |

| Avalanche (AVAX) | 19 | Proof-of-Stake |

| Toncoin (TON) | 20 | Proof-of-Stake |

| OKB (OKB) | 25 | Proof-of-Stake |

Source: Digital Asset Research | Data as of 5 Aug 2023

Due to its heavy consumption of electricity, in most parts of the world, PoW mining operations are more likely to derive their electricity from carbon-intensive electricity sources, such as petroleum or natural gas. The level of carbon and greenhouse gas emitted from the combustion of the two energy sources has raised various environmental concerns in the past decade.

In contrast, as PoS blockchains do not require as much electricity, renewable energy sources are usually used in place of non-renewable energy. This is because, with lower energy demands, PoS blockchains have the potential to be more flexible in choosing energy sources. Renewable sources like solar, wind, hydroelectric, or geothermal power could replace fossil fuels. This has contributed to the perception of PoS blockchains being generally better among environmentally conscious individuals and institutions.

In addition, PoS blockchains have fewer hardware requirements, allowing for a reduction in electronic waste, a stark contrast to PoW blockchains that require specific mining devices.

Source: Ethereum.org

Conclusion

In conclusion, PoS and staking activities are significant components of the digital asset market. The majority of top assets by market capitalization with smart contract functionality have adopted PoS in recent years. While there are ongoing discussions and improvements that can be implemented in the existing PoS landscape, PoS is currently the dominant consensus mechanism for Web3 and decentralized applications.

Staking Details For Individual Assets

Information on staking for individual assets appears below, in addition to a Glossary that defines terms related to staking.

Ethereum (ETH), Solana (SOL), and Cardano (ADA) are included in this sample.

Cardano (ADA)

DAR Asset ID

DA22JZ7

Key Links

| Staking Information | Link |

| Explorer | Link |

| Validator Information | Link |

Staking Information

| Minimum Staked Amount | A wallet must hold a minimum of 1 ADA to be eligible for delegation, while no minimum is required to run a stake pool. |

| Lock Up Period | No lock-up period when staking to a Cardano stake pool. |

| Wind Down Period | None. |

| Slashing Mechanism | There is no slashing mechanism for Cardano, but poor node behavior can lead to missed rewards. |

Additional Information

- ADA holders have two options for earning rewards within the Cardano network: Delegate their stake to a stake pool that another user manages, or manage their own stake pool.

- Daedalus is a full-node wallet and Yoroi is a browser-based wallet that supports delegation.

Ethereum (ETH)

DAR Asset ID

DASK8KY

Key Links

| Staking Information | Link |

| Explorer | Link |

| Validator Information | Link |

Staking Information

| Minimum Staked Amount | 32 ETH |

| Lock Up Period | Staking withdrawals were enabled after the Shapella upgrade occurred on 12 April 2023. The maximum number of withdrawals that can be processed in one block is 16. |

| Wind Down Period | As of the Shapella upgrade, staked ETH can be withdrawn, but there is a daily limit to the amount of ETH that can be withdrawn. |

| Slashing Mechanism | Minor slashing penalties are imposed for actions or inactions that unintentionally impede consensus. Malicious actions trigger major penalties or slashes. If a validator is slashed, 1/32 of their staked ETH (up to a maximum of 1 ETH) is immediately burned. |

Additional Staking Information

- Each deposit of 32 ETH for staking activates a set of validator keys, which are used to validate the network’s status.

- A validator will automatically be removed from the validator set if its balance falls below 16 ETH. Validators with a balance approaching 16 ETH are encouraged to “top up” their balance by adding additional ETH.

Solana (SOL)

DAR Asset ID

DAXVC4R

Key Links

| Staking Information | Link |

| Explorer | Link |

| Validator Information | Link |

Staking Information

| Minimum Staked Amount | No minimum amount of SOL is required to stake. However, to participate in consensus, token holders must have a voting account, which can cost up to 1.1 SOL daily. |

| Lock Up Period | Solana has no mandatory lock up period for staking, but a stake account can optionally set a lock up period when it is established. This lockup period can be modified by the stake account’s lockup authority or custodian. |

| Wind Down Period | None at the network level. However, if a lockup was implemented by a validator, then a wind down period may be applicable. |

| Slashing Mechanism | Solana has slashing rules which, if violated, will cause some amount of the offending validator’s deposited stake to be removed from circulation. For validators that go offline or fail to validate transactions during the validation period, their annual rewards are reduced. |

Additional Information

- If a stake account is not delegated and all of its tokens are withdrawn to a wallet address, the account at that address is eliminated. It must be manually recreated before it can be used again.

Glossary

Delegation: The process by which token holders delegate their tokens to an entity associated with a staking pool.

Epoch Time: A standardized, specific length of time used to identify a period in which network events occur. An epoch may determine items such as when rewards are distributed or when validators are assigned to validate transactions.

Lock Up Period: A period of time during which validators or delegators are unable to unstake or withdraw their staked tokens.

Minimum Staked Amount: The minimum amount required to participate in securing the network and validating blocks by being a validator or delegator.

Reward Distribution: Rewards distributed to validators and delegators in exchange for their contributions to the network’s security and validation processes.

Slashing/Slashing Mechanism: Mechanisms that are implemented to maintain the integrity of the network by penalizing participants who engage in behaviors that could harm the network’s security or stability.

Slot Size: The period of time for which transactions can be processed in a single block.

Stake Pools: Pools of funds run by operators who have the knowledge and resources to ensure the node runs consistently. Delegators often stake their tokens through stake pools.

Validator Uptime: A measure of a validator’s reliability and consistency in casting votes on transactions added to the blockchain.

Wind Down Period: Any period after a validator or delegator submits a request to withdraw their staked tokens, during which they are unable to access their tokens. Validators or delegators are able to withdraw their staked tokens after the wind down period ends.

DISCLAIMER

All information is provided for information purposes only and provided “as is” without warranty of any kind. Neither Digital Asset Research (“DAR”) nor its respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, express or implied, as to the accuracy, timeliness, completeness, merchantability or the fitness or suitability for any particular purpose of any information contained herein or any information or results to be obtained from the use of DAR products.

DAR may have a business relationship with some of the tokens, projects or entities named in this report, but every effort is made to ensure the impartiality and objectivity of the research.

Neither DAR, nor its respective directors, officers, employees, partners or licensors, provide investment advice and nothing contained in this document constitutes financial, investment, tax, or legal advice. No responsibility or liability can be accepted by DAR nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analyzing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever resulting from the use of, or inability to use, such information. No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means without prior written permission of DAR.

Use and distribution of any data or product provided by DAR requires a license from DAR and/or their respective licensors.