YOU ARE RESPONSIBLE FOR DETERMINING WHETHER ANYTHING CONTAINED HEREIN IS SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES, AND FOR SEEKING PROFESSIONAL TAX, LEGAL, AND/OR INVESTMENT ADVICE AS APPROPRIATE. PLEASE SEE THE OTHER DISCLAIMERS AT THE END OF THIS REPORT.

OVERVIEW AND ASSET VETTING DESCRIPTION

Over the past decade, digital assets have emerged to become one of the most fascinating asset classes. From early 2020 to 2023, the total market capitalization of digital assets went from approximately $200 billion to a peak of ~$3 trillion in late 2021, before retracing back to the $1 trillion range. This exceptional fluctuation raised mainstream awareness and increased institutional investors’ interest in digital assets.

However, digital assets are not without their own unique risks. The overwhelming and ever-expanding number of digital assets, their open-source nature, and regulatory ambiguity all contribute to the need for a comprehensive diligence process. Additionally, digital assets are a nascent asset class, often making them more akin to venture capital investments than blue-chip public equities.

A robust digital asset vetting process allows institutional market participants to understand an asset’s unique risks, potential value, and regulatory standing. Below, we explore the importance of selected key factors to consider when assessing digital assets.

KEY DIGITAL ASSET VETTING FACTORS

In this section, we detail key factors institutional investors should assess to understand a digital asset’s risks and potential value.

Token Use Cases, Economics, and Supply-Demand Dynamics

One unique attribute of digital assets is their ability to have multiple use cases. Unlike traditional equities that represent ownership and voting rights in a company, digital asset use cases are defined in their code and can vary to include functionality like securing a blockchain network, owning a certain percentage of a protocol’s revenue, holding protocol governance rights, or more. Gaining an understanding of how and why a digital asset is used is an important step in vetting the asset.

Relatedly, understanding a digital asset token’s economics or “tokenomics”, including how the token was initially launched and distributed, is crucial for assessing the asset’s long-term sustainability. A digital asset’s supply-demand mechanism will also affect its circulating supply and inflation rate, which are factors that can potentially impact its price.

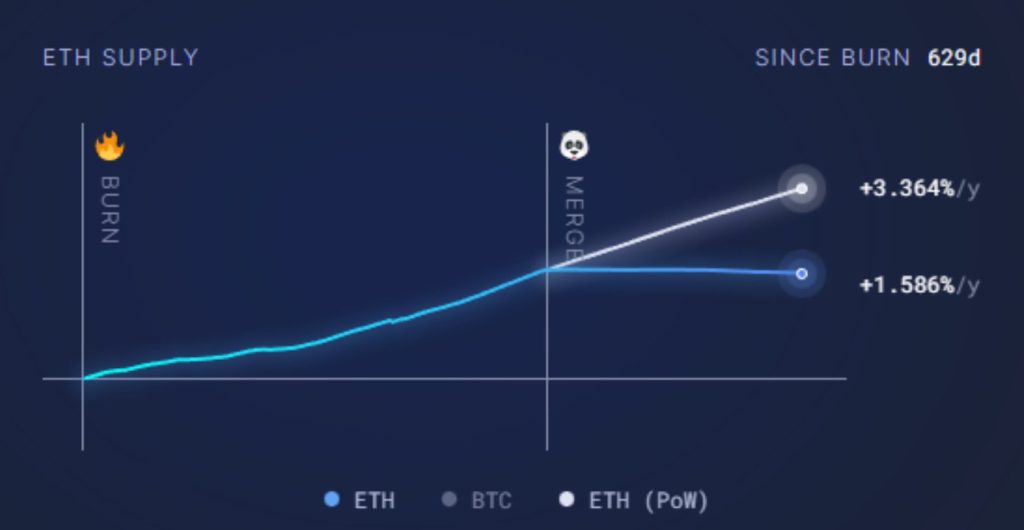

For example, Ethereum completed its “Merge” upgrade in September 2022, which fully transitioned the network’s consensus mechanism from Proof-of-Work to Proof-of-Stake. The upgrade changed the way new ETH is issued and, as a result, the supply rate for ETH decreased, which resulted in a lower inflation rate.

Source: ultrasound.money

Technology and Cryptographic Standards

Digital assets rely on their underlying technology and cryptographic standards to ensure security, scalability, and performance. To vet an asset, it is critical to understand how its underlying blockchain or distributed ledger technology (DLT) works. Factors such as permission requirements, transaction speed, energy efficiency, and interoperability with other blockchain networks are important considerations when assessing an asset’s potential longevity, safety, or possible investment growth.

Additionally, assessing the cryptographic standards used to secure an asset’s network to determine if they meet current best practices set by organizations such as the National Institute of Standards and Technology (NIST) is a key step in identifying potential vulnerabilities. For example, Ethereum utilizes the Elliptic Curve Digital Signature Algorithm (ECDSA), which is a NIST-approved signature algorithm; whereas Solana, a newer asset than Ethereum, utilizes an EdDSA signature algorithm, which is based on a newer elliptic curve that the NIST only adopted as of February 2023.

Codebase Assessment

A secure and well-maintained codebase is important for the success of a digital asset. Unlike traditional software, the smart contracts used by digital assets have unique properties that make it much more difficult to change their underlying code after it is published.

To assess a digital asset’s codebase, check that the asset has undergone independent smart contract audits from reputable firms and addressed any codebase vulnerabilities. The asset should also be taking active measures to further ensure its safety, possibly including incentivizing white hat hackers via bug bounties or engaging third-party intelligence firms to monitor for any potential loopholes in the codebase.

For example, a proposal to update Aave’s risk parameters was submitted to the protocol’s governance forum by a third-party risk management firm. As a DeFi lending protocol, it is critical for Aave to have monitoring for its risk parameters to prevent the accumulation of bad debt. A bad debt can occur if a malicious actor tries to game the lending-borrowing system; such an event happened in November 2022.

Validation and Consensus Mechanism

The consensus mechanism and validation process are core to the security of a digital asset’s network, as well as the network’s capability to scale and resist attacks. Evaluating the consensus mechanism (such as Proof-of-Work or Proof-of-Stake) that an asset’s network uses and considering related tradeoffs between security, decentralization, scalability, and energy efficiency are important when vetting a digital asset.

Often, founders and original investors have a high level of control over newer assets, which adds an element of centralization and counterparty risk. When vetting a digital asset, it is important to evaluate if there is enough validator (or miner) diversity to ensure that the blockchain network is not susceptible to bad actors or collusion among participants.

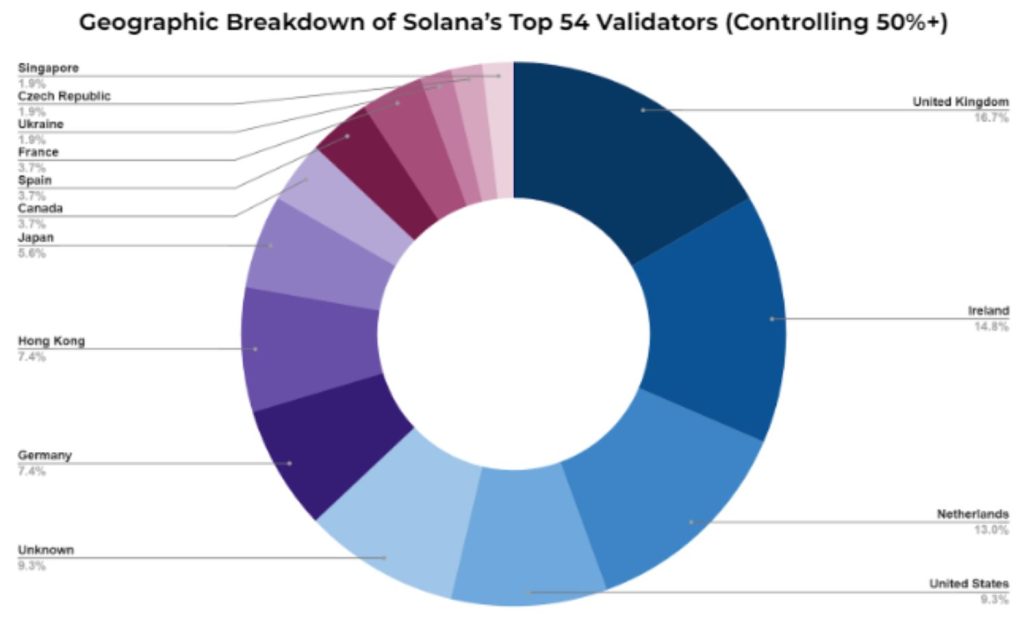

For example, Solana is a newer blockchain network than Ethereum. As of March 2023, the top 54 Solana validators control more than 50% of the network. By contrast, Ethereum hit over 500,000 validators as of January 2023. As a best practice, the number of validators should increase as a network decentralizes.

Source: https://solanabeach.io/validators

Regulatory Compliance

As a new and digital-first asset class, digital assets must navigate a complex and evolving cross-jurisdictional regulatory landscape. Market participants from all over the world can interact in on-chain digital asset markets, which means that digital assets are exposed to regulatory requirements globally. Issuers of digital assets need to understand the legal landscape extremely well and ensure compliance with regulations.

As part of asset vetting, evaluating a project’s legal strategy and its approach to addressing potential regulatory issues is crucial. In addition, it is important to consider whether an asset’s use cases might draw scrutiny from regulators, with revenue sharing and stablecoin mechanisms drawing the most attention from regulators historically.

For example, the U.S. Securities and Exchange Commission (SEC) charged LBRY for conducting an unregistered sale of “crypto asset securities”. The SEC won the case and LBRY was unable to continue its development, citing that the company had to pay millions of dollars in legal fees.

Network Health and Decentralization

The ultimate goal of any permissionless blockchain network is to decentralize. For instance, the founder of Ethereum, Vitalik Buterin, no longer has controlling power over the network. Although Buterin has a strong reputation and following, at this point his influence and impact over Ethereum is dependent on his work.

A healthy and decentralized network is vital for the long-term sustainability and growth potential of a digital asset. As part of asset vetting, evaluate the network’s decentralization by examining factors such as the distribution of token holdings, node distribution, and its governance structure. Often, a blockchain network might look like it has been decentralizing, but the ultimate owners of the underlying tokens might only be a small number of groups; this is akin to an individual that obfuscates corporate ownership via shell companies.

Additionally, it is critical to assess the network’s robustness by looking at metrics such as transaction density, cliques, and network paths. These metrics provide insight into how value is being transferred in the network. A decentralized blockchain network should have fairly decentralized network metrics.

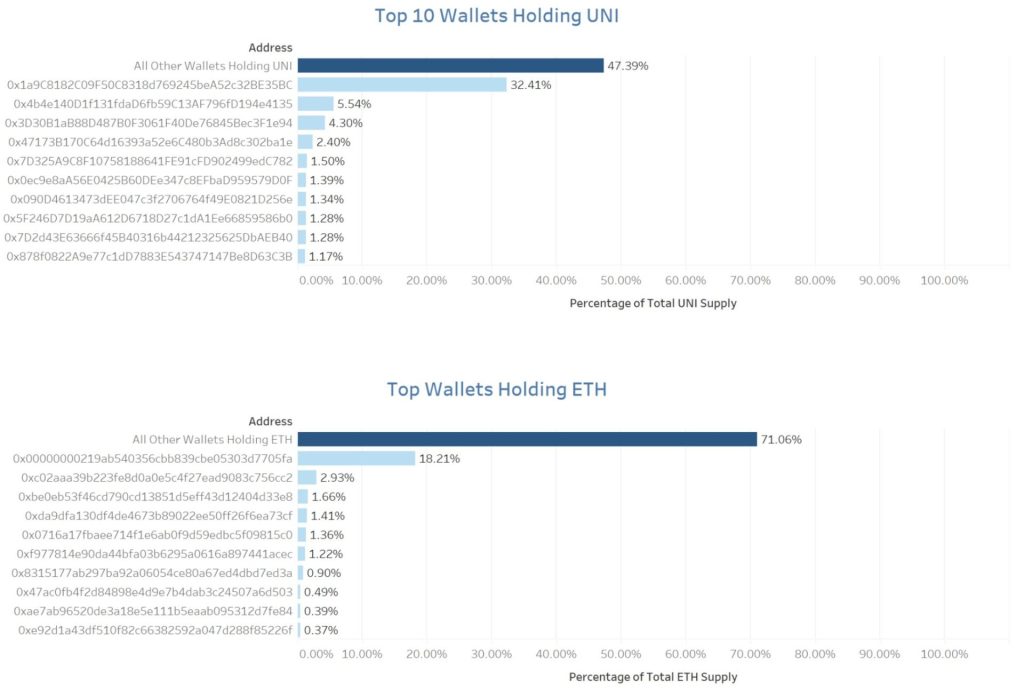

For example, the top 10 richest wallets for Ethereum hold ~28.94% of ETH’s total supply, while the top 10 richest wallets for Uniswap hold ~52.61% of UNI’s total supply as of 17 May 2023.

Source: Digital Asset Research

ASSET VETTING TAKEAWAYS

As institutional market participants increasingly explore digital assets, a rigorous vetting process is essential to assess the strength and legitimacy of an asset. By carefully evaluating factors related to token use cases, tokenomics, technology, cryptography, codebase construction, regulatory compliance, and decentralization, institutional participants can make informed decisions and minimize their risks when interacting with this emerging asset class.

CASE STUDY: Terra Luna

Terra, a popular blockchain platform, experienced a catastrophic setback when its UST stablecoin destabilized and lost its peg in 2022. UST was designed to maintain a 1:1 peg to the US dollar, but lost its peg due to a death spiral caused by its stability mechanism, resulting in billions of dollars in losses for investors.

Background

Terra is a blockchain network with a dual native token system. LUNA, the network’s native token, serves as the governance and gas token powering the underlying blockchain network. UST, the network’s native stablecoin, is algorithmically pegged to LUNA via an arbitrage mechanism.

The relationship between LUNA and UST was that 1 UST could always be redeemed for $1 worth of LUNA, regardless of the current market price of LUNA. When the price of UST went below $1, investors could buy UST for less than $1, exchange it for $1 worth of LUNA, and sell LUNA in the open market for profit.

Additionally, the supply of LUNA was elastic. As a result, when the price of UST decreased, new LUNA was issued and sold on the open market by arbitrageurs. This loop caused the price of LUNA to further drop, leading to a death spiral.

The UST Stablecoin Failure

UST’s algorithmic design was the primary factor that caused its failure. The mechanism relied on LUNA as collateral to support UST’s value, but the value of LUNA was highly volatile. This volatility undermined the stability of UST, and eventually led to a rush to exit that turned into a death spiral. What happened to LUNA was a combination of a traditional bank run combined with a circular looping mechanism that led to a loss of value for both LUNA and UST.

How Digital Asset Vetting Could Have Helped

A comprehensive digital asset vetting process would have included a thorough examination of the supply-demand dynamics of the LUNA token. Through asset vetting, market participants would have learned about:

- Potential risks associated with the nature of the LUNA asset’s issuance. A deep evaluation of the digital asset space would have also shown that similar concepts had not been successful previously.

- A lack of transparency in Terra’s governance structure. The capital that was raised to defend the 1:1 peg might have not been utilized appropriately.

- Demand for UST being artificially inflated via Anchor protocol, an entity that was associated with the team behind Terra, which promised a 20% annual yield on a stablecoin that was supposedly pegged to the U.S. dollar.

Conclusion

The failure of Terra’s UST stablecoin serves as a reminder of the importance of thorough due diligence and digital asset vetting for institutional market participants. By carefully examining a digital asset’s supply-demand dynamics and governance structure, market participants can better understand potential pitfalls and make informed decisions about whether to interact with a particular digital asset.

In the case of Terra LUNA’s UST stablecoin, a rigorous vetting process could have helped investors identify the red flags in its algorithmic design, the lack of transparency surrounding its governance, and potential liquidity challenges.