DAR’s vetting processes bring institutional-level diligence to crypto markets and the latest vetting process results in 15 Vetted Exchanges and 8 Watchlist Exchanges

New York, NY, April 12, 2023 – Digital Asset Research (DAR), a leading provider of crypto asset data and research, today announced the release of its April 2023 Crypto Exchange Vetting results. In an environment where cryptocurrencies trade across hundreds of lightly regulated or unregulated exchanges, DAR’s vetting processes apply institutional-level diligence to digital asset markets to meet an industry-wide need for reliable crypto data.

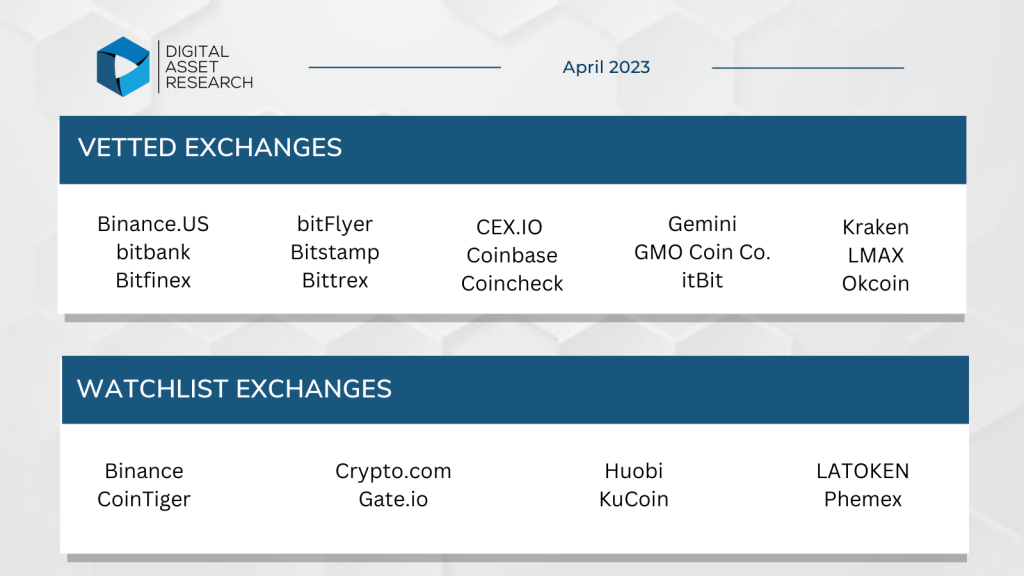

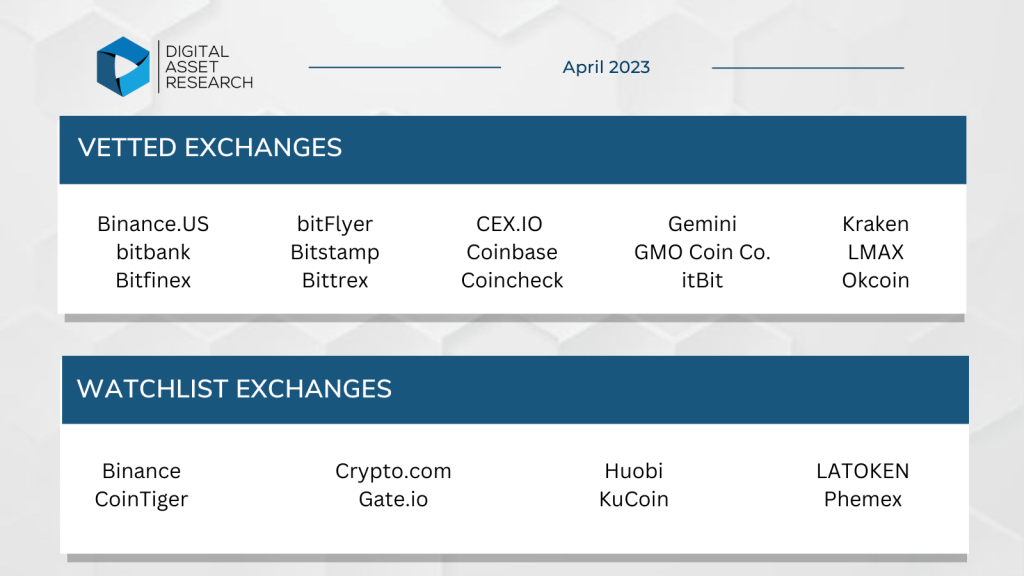

Over 450 exchanges were evaluated to identify 15 Vetted Exchanges. The following exchanges continue to maintain their status as Vetted Exchanges: Binance.US; bitbank; Bitfinex; bitFlyer; Bitstamp; Bittrex; CEX.IO; Coinbase; Coincheck; Gemini; itBit; Kraken; LMAX; and Okcoin. GMO Coin Co. is added as a new Vetted Exchange. Bitso, BTC Markets, CrossTower, and Zaif are no longer Vetted Exchanges.

Eight exchanges are now considered Watchlist Exchanges for potential future inclusion on the Vetted Exchanges list: Binance; CoinTiger; Crypto.com; Gate.io; Huobi; KuCoin; LATOKEN; and Phemex. Bitrue and CoinEx are no longer Watchlist Exchanges.

The Exchange Vetting process combines quantitative and traditional qualitative due diligence to identify exchanges reporting accurate volumes and eliminate exchanges that are not appropriate for determining an accurate market price.

“Our mission is to provide the highest quality data in the industry,” said Doug Schwenk, DAR’s CEO. “Our quarterly analysis of digital asset exchanges underpins our prices for 10,000+ crypto assets. In addition, it helps our institutional customers identify venues with more reliable market activity, less likely to have been manipulated.”

The Exchange Vetting process follows an Asset Vetting process that was completed in March and evaluated over 1,000 digital assets to identify assets appropriate for various institutional use cases. During the Asset Vetting process, digital assets are evaluated to determine if they meet institutional investor standards for codebase construction and maintenance, community, security, liquidity, and regulatory compliance.

Results of the Exchange Vetting process determine pricing sources used to calculate DAR reference prices for institutional clients, including Bloomberg, Chainlink, FTSE Russell, the FTSE DAR Reference Price, and Refinitiv.

DAR performs its Exchange Vetting processes quarterly. Results will next be announced in July 2023.

To learn more, book a consult.