YOU ARE RESPONSIBLE FOR DETERMINING WHETHER ANYTHING CONTAINED HEREIN IS SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES, AND FOR SEEKING PROFESSIONAL TAX, LEGAL, AND/OR INVESTMENT ADVICE AS APPROPRIATE. PLEASE SEE THE OTHER DISCLAIMERS AT THE END OF THIS REPORT.

For a PDF version of this report, please click here.

INTRODUCTION

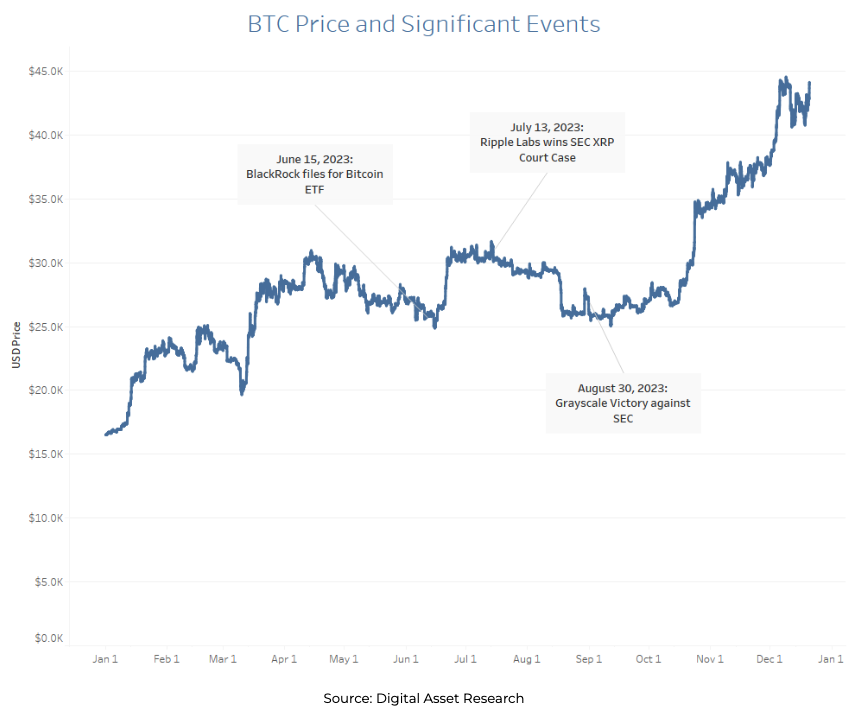

In 2023, total digital asset market capitalization doubled as it went from ~$830 billion to ~$1.6 trillion, with Bitcoin’s price rising from ~$16,500 to ~$44,000 during the year. Numerous spot Bitcoin ETF filings, movement in the regulatory landscape, and positive indications from institutions entering or planning to enter the space signaled broader institutional support for the asset class, which could indicate a more institutional-first and compliant digital assets ecosystem in 2024. This report delves into the rejuvenated digital assets market of 2023 and looks forward to potential 2024 trends.

Note that this report is meant for informational purposes only, and should not be construed as investment, financial, or legal advice.

2023 IN REVIEW

The digital asset landscape experienced significant turbulence over the past couple of years, with the price of Bitcoin hitting an 18-month low of approximately $16,500 as of January 2023. This low followed a string of negative events, including the insolvency of several crypto protocols, exchanges, lenders, and asset managers such as Terra UST stablecoin, FTX exchange, and Three Arrows Capital in 2022. However, towards the end of 2023, digital asset prices began rising, with Bitcoin returning more than 150% overall in 2023.

Several contributing factors may explain the asset class’ resurgence, including the possibility of the U.S. Federal Reserve reversing its stance on interest rate hikes, BlackRock’s entrance into the spot Bitcoin ETF race, and a few regulatory wins for the industry such as Ripple Labs and Grayscale winning court cases against the U.S. Securities and Exchange Commission (SEC).

2023 Crypto Market Performance Across Top Assets

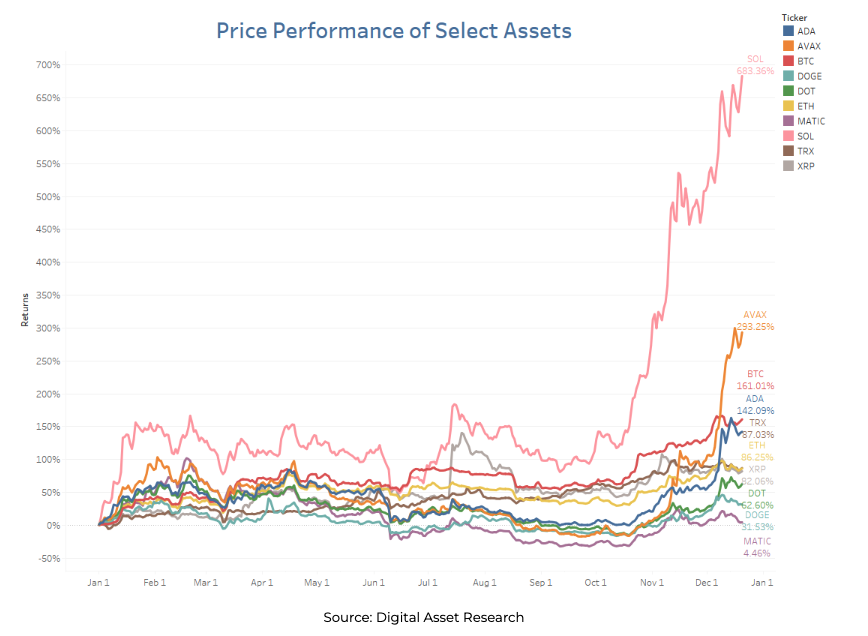

The following charts and tables review crypto market performance in 2023, with a particular focus on Bitcoin (BTC), Ethereum (ETH), and eight of the largest digital assets by market capitalization, excluding stablecoins and wrapped or liquid staked assets.

Price Performance

In 2023, Solana (SOL) was the best performer amongst the ten selected assets as it returned over 683%, whereas Polygon (MATIC) was the most significant laggard, returning 4.46%.

Market Cap

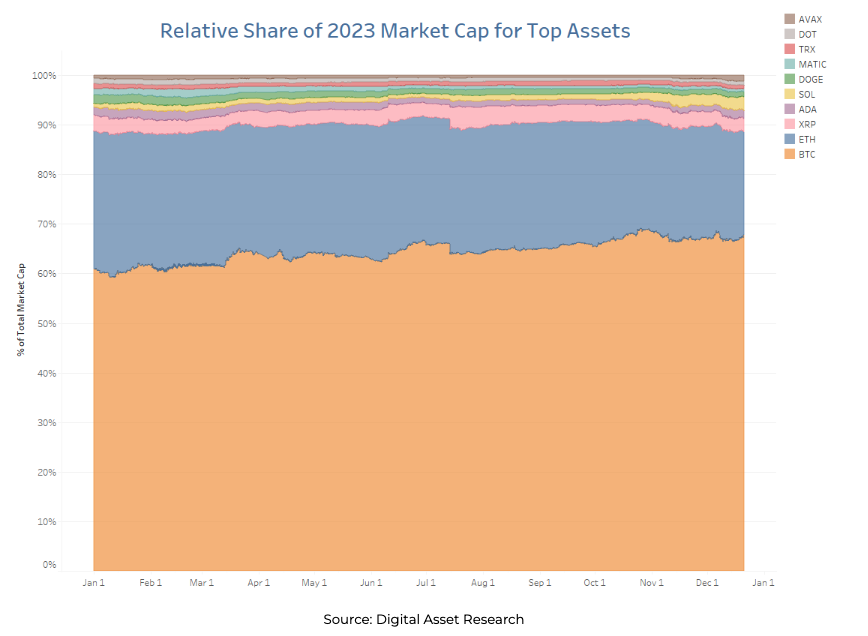

As of mid-December 2023, BTC has a market capitalization of approximately $850 billion, contributing to an overall digital asset total market capitalization of around $1.6 trillion.

When looking at the ten selected digital assets, BTC’s relative share of market capitalization increased by 6.58% in 2023 as it rose to 67.49%. During the same period, ETH’s share of relative market capitalization amongst these assets decreased by 6.57% to 21.25%.

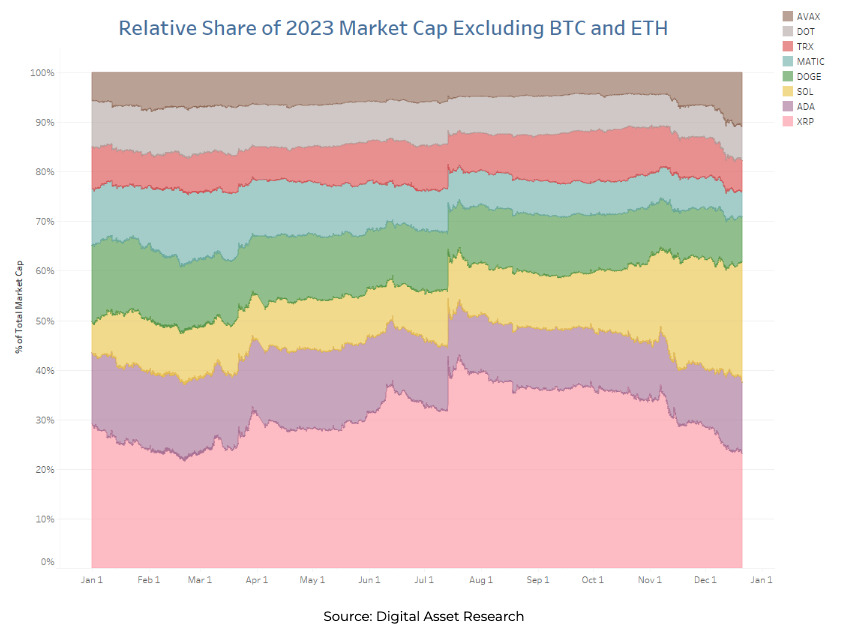

When BTC and ETH are excluded from the set of selected top assets, SOL and Avalanche (AVAX) posted notable increases in their share of relative market cap in 2023, with SOL recording a 6.22% increase to 23.75% and AVAX recording a 5.07% increase to 10.85%.

Trading Volume

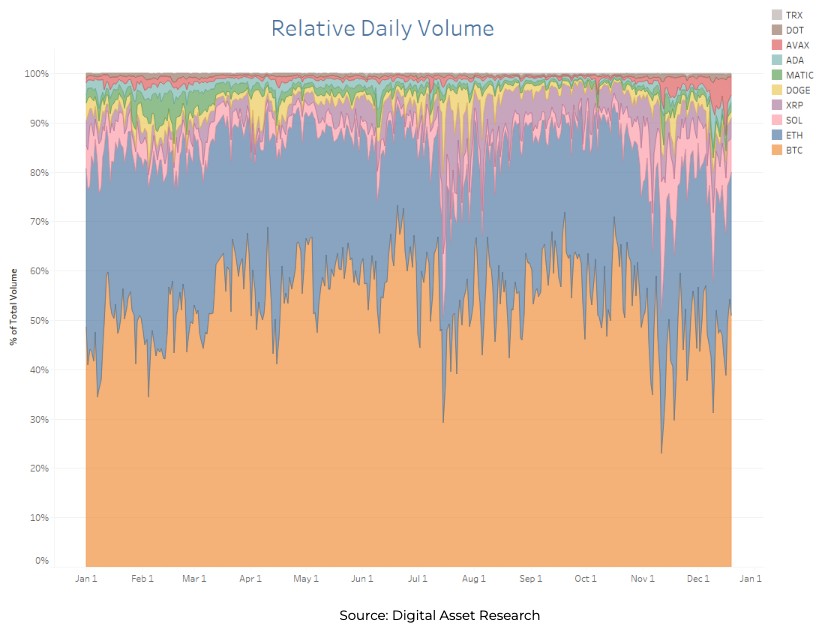

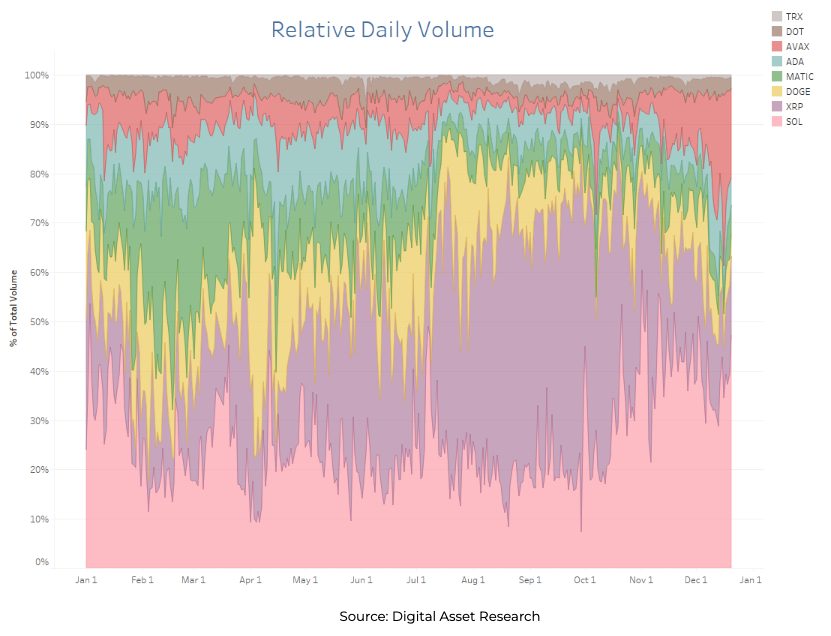

Examining volume from DAR Vetted Exchanges provides insights on which assets recorded the highest proportions of verifiable trading activity. Amongst the ten selected assets, BTC and ETH dominated relative daily volume metrics. BTC’s share of relative daily volume peaked on June 20 at 73.20%, while ETH peaked on January 7 at 47.36%.

If BTC and ETH are excluded, XRP (XRP), SOL, and AVAX recorded notable relative daily volume on Vetted Exchanges in 2023. XRP’s relative daily volume peaked at 78.53% on September 29, SOL’s relative daily volume peaked at 11.79% on November 13, and AVAX’s relative daily volume peaked at 11.19% on December 16.

Bitcoin Daily Returns

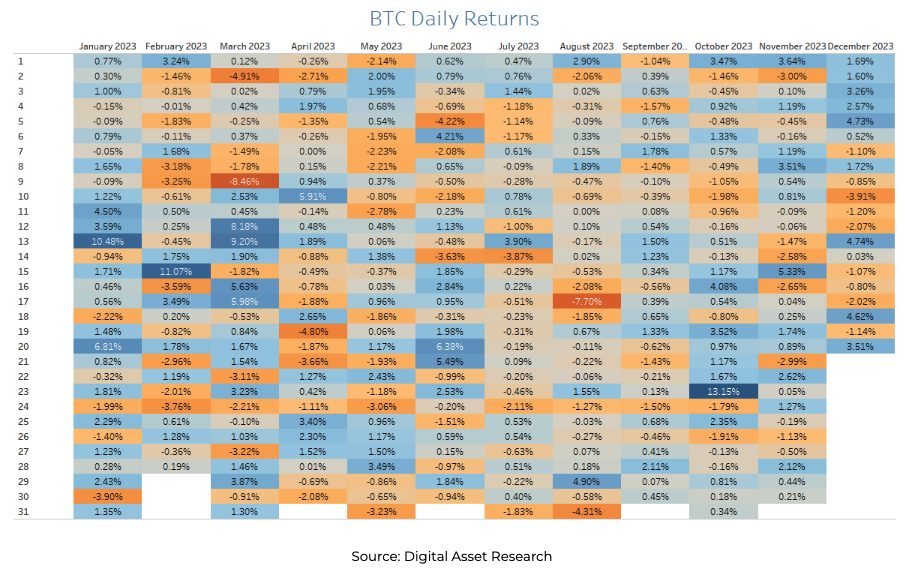

In 2023, BTC’s price increased by over 150%. The large majority of its price appreciation happened in the fourth quarter, but there was a consistent upward trajectory throughout most of the year, with the first quarter showing the most volatility and inconsistent daily returns.

When looking at BTC’s daily returns, the most significant daily downturn happened on March 9 when the price of Bitcoin fell by 8.46%, whereas the most significant daily return happened on October 23 when the price of Bitcoin increased by 13.15%.

Performance of Assets with Over $100M in Market Capitalization

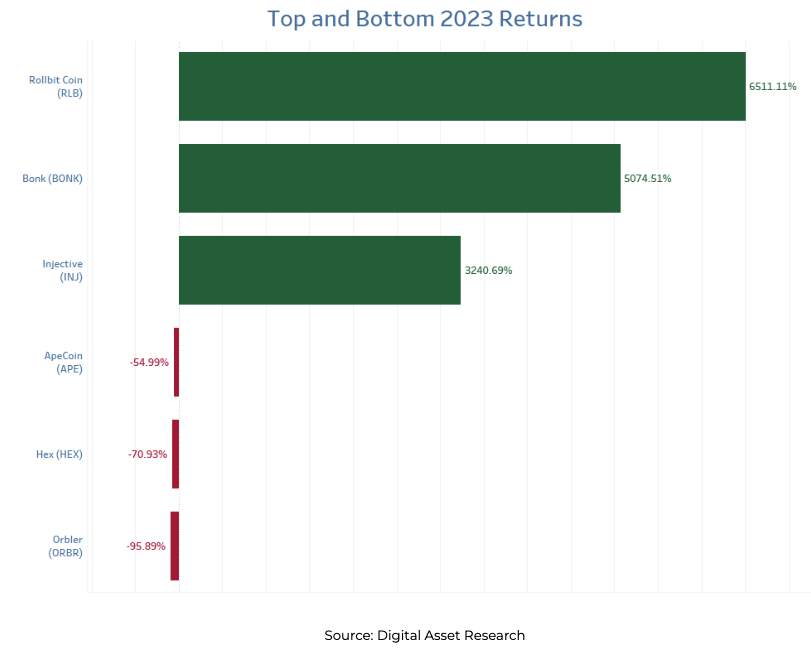

In 2023, the best-performing digital assets with over $100M in market capitalization were Rollbit Coin (RLB), Bonk (BONK), and Injective (INJ). These assets delivered massive returns, with RLB rising 6,511.11%, BONK increasing 5,074.51%, and INJ going up 3,240.69%.

On the other side, Orbler (ORBR), Hex (HEX), and ApeCoin (APR) were the most significant laggards amongst tokens with over $100M in market capitalization. In 2023, ORBR returned -95.89%, HEX returned -70.93%, and APE returned -54.99%.

2023 Institutional Crypto Markets

Spot Bitcoin ETF Filings

BlackRock’s decision to file for a spot Bitcoin ETF in June 2023 was a pivotal moment that created a wave of positive sentiment across the broader market.

BlackRock’s filing led to a series of digital asset ETF applications from other institutional market participants as interest in regulated digital asset products increased.

More than 20 crypto ETF applications were submitted to the Securities and Exchange Commission (SEC) in 2023. Collectively, the entities behind these applications manage more than $20 trillion in assets, with BlackRock and Fidelity being the largest asset managers among the applicants.

Select 2023 Digital Asset ETF Activities in the United States

| Entity | Digital Asset ETF Activities |

|---|---|

| BlackRock | 15 June 2023 – Spot Bitcoin ETF Application 15 November 2023 – Spot Ether ETF Application |

| WisdomTree | 20 June 2023 – Spot Bitcoin ETF Application |

| Valkyrie | 21 June 2023 – Spot Bitcoin ETF Application 17 August 2023 – Ethereum-focused ETF Application |

| Volatility Shares | 27 June 2023 – Launched 2x Bitcoin Strategy ETF 28 July 2023 – Ether Futures ETF Application |

| Invesco Galaxy | 30 June 2023 – Spot Bitcoin ETF Application |

| Grayscale | 1 August 2023 – Ethereum Futures ETF Application 19 September 2023 – Proposed listing and trading shares of the Grayscale Ethereum Futures Trust ETF 19 October 2023 – Spot Bitcoin ETF Application |

| BitWise | 1 August 2023 – Ether Strategy ETF Application |

| Roundhill Investment | 1 August 2023 – Ether Strategy ETF Application |

| Direxion | 2 August 2023 – Combined Bitcoin and Ether Futures Fund Application |

| Global X | 4 August 2023 – Bitcoin Trust Application |

| ARK Invest and 21Shares | 11 August 2023 – Bitcoin Futures ETF Application 11 August 2023 – Digital Asset and Blockchain Strategy ETF Application 11 August 2023 – Active On-Chain Bitcoin Strategy ETF Application 24 August 2023 – Ethereum Futures ETF Application |

| VanEck | 1 August 2023 – Ether Strategy ETF Application 28 September 2023 – Prepared to launch Ethereum Futures ETF (EFUT) |

| ProShares | 1 August 2023 – Short Ether Strategy ETF Application 14 October 2023 – Prepared to launch unique Short Ether Strategy ETF 2 November 2023 – Launched Short Ether Futures ETF |

| Hashdex | 25 August 2023 – Bitcoin Futures ETF Application |

| Franklin Templeton | 12 September 2023 – Spot Bitcoin ETF Application |

| Fidelity | 17 November 2023 – Spot Ethereum ETF Application |

| Pando Asset | 29 November 2023 – Spot Bitcoin Trust Application |

Institutional Adoption

More than a year after systemic shocks to digital asset markets, such as the collapses of the Terra UST stablecoin, FTX exchange, and Three Arrows Capital, institutional adoption is again increasing with investors signaling that they are committing to digital assets and will continue to actively invest in the space.

Coinbase, the largest U.S.-based digital asset exchange, released a survey of asset managers in November 2023. Among other findings, the survey found:

- 64% of current digital asset investors surveyed expect to increase allocations in the next three years

- 45% of institutional investors surveyed without digital assets allocations expect to allocate in the next three years

- 57% of institutional investors surveyed believe prices will move higher in the next 12 months, compared to just 8% who shared that view in October 2022

Additionally, adoption amongst institutional product sponsors continues as companies seek to differentiate their portfolios in an increasingly competitive landscape. Strategies such as the launch of the FTSE Grayscale Sector Index Series underscored digital asset market participants’ commitment to innovation and diversification. Concurrently, risk management strategies via digital asset derivatives also continue to evolve, exemplified by initiatives like Eurex’s launch of Bitcoin futures and options.

Regulatory Landscape Changes

In 2023, the global regulatory landscape for digital assets underwent diverse developments, reflecting the varying stances of different nations. The European Union introduced the Markets in Crypto-Assets (MiCA) framework, a comprehensive regulatory system focusing on crypto-asset markets and targeting stablecoins. On the other side of the globe, the United States grappled with regulatory clarity, struggling to define jurisdictional responsibilities between agencies like the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Similar regulatory developments can also be observed in Asia. Countries like Singapore, Japan, and Hong Kong have started establishing crypto rules. In Japan, a detailed regulatory framework involving collaboration between the Financial Services Agency (FSA), Japan Virtual and Crypto Assets Exchange Association (JVCEA), and Japan Security Token Offering Association (JSTOA) established measures like the Payment Services Act and stringent anti-money laundering practices.

In Singapore, the Monetary Authority of Singapore (MAS) acts as a regulator that oversees institutions in banking, capital markets, insurance, and payments. In August 2023, the MAS finalized its stablecoin regulatory framework, aiming to oversee single-currency stablecoins (SCS) pegged to the Singapore Dollar or any G10 currency that are issued in Singapore.

In Hong Kong, the regulatory landscape is actively evolving under the Hong Kong Monetary Authority (HKMA) guidance. The HKMA issued a discussion paper on crypto-assets and stablecoins and published its conclusion of the discussion, marking a significant milestone in Hong Kong’s journey to establish a comprehensive and adaptive regulatory environment for the digital asset market.

| Quarter I | Quarter II | Quarter III | Quarter IV | |

|---|---|---|---|---|

| United States | Internal Revenue Service (IRS) seeks to tax NFTs | – New stablecoin bill drafted by Republican chair of the House of Representatives Financial Services Committee – Securities and Exchange Commission (SEC) charged Coinbase for operating as an unregistered securities exchange, broker, and clearing agency – SEC filed 13 charges against Binance entities and its founder, Changpeng Zhao | – IRS released proposed regulations on sales and exchanges of digital assets by brokers – IRS released new tax guidance on staking rewards – Grayscale won a lawsuit against the SEC | – Ripple won partial victory against the SEC – SEC dropped claims against two Ripple Labs executives – SEC charged Kraken for operating as an unregistered securities exchange, broker, and clearing agency – Binance pleaded guilty to Justice Department charges related to anti-money laundering, unlicensed money transmission, and sanctions violations and agreed to pay $4B |

| Europe | European Union (EU) postponed MiCA vote to April 2023 | – The European Parliament adopted Markets in Crypto Assets (MiCA) legislation – European Commission published its Digital Euro Bill – EU implemented regulations for tracing crypto transactions | European Securities and Markets Authority (ESMA) issued first proposed set of detailed crypto rules under MiCA | – Agreed on new crypto tax data sharing rules – European commission deferred decision on DeFi regulation – EU Parliament approved data act with smart contract kill switch provision |

| Japan | Japan’s Financial Services Agency (FSA) pushed global counterparts to regulate crypto like banks | FSA announced participation in pilot project from Monetary Authority of Singapore (MAS) focused on testing digital asset technologies | Allowed startups to raise funds by issuing crypto | Japan prepared to relax crypto taxation policies |

| Singapore | Blockchain Association of Singapore (BAS) lobbyists opposed proposed blanket ban on lending crypto tokens | MAS proposed design framework for interoperable Digital Asset Networks | MAS finalized stablecoin regulatory framework | Singapore’s Central Bank started tokenization and CBDC trials |

| Hong Kong | Hong Kong Securities and Futures Commission (SFC) to propose approved tokens for retail | SFC to accept license application for crypto exchanges | Officially opened crypto trading to retail investors | SFC set requirements for asset tokenization |

2024 CRYPTO DATA TRENDS

Entering 2024, some key events and trends that are likely to shape the digital asset industry and its data needs are outlined below.

Trend #1: Bitcoin’s Halving

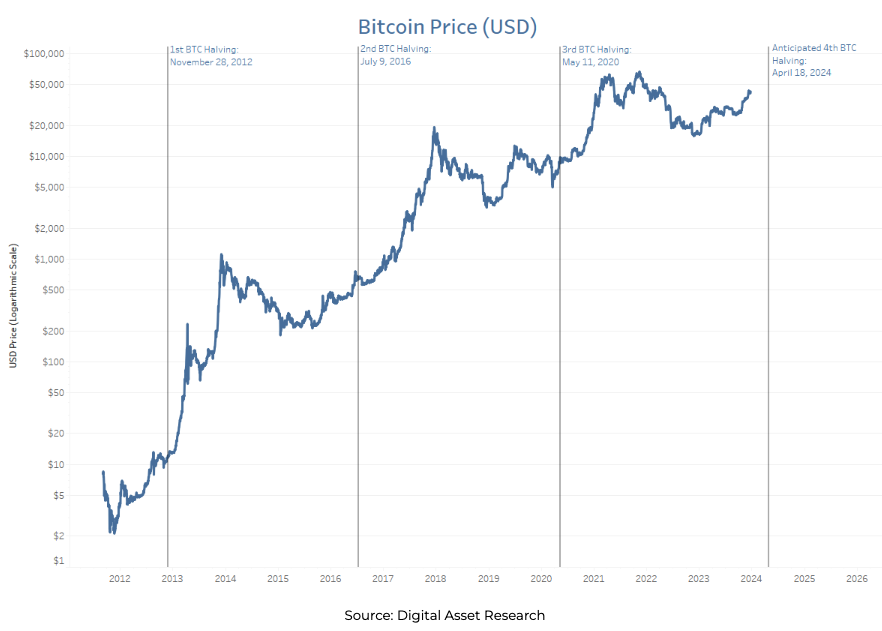

Bitcoin’s halving is an event that happens approximately every four years and is integral to its mining algorithm. This process, built to balance inflation and uphold scarcity, involves a 50% reduction in mining rewards. Halving events have occurred in November 2012, July 2016, and May 2020, with the fourth slated for April 2024. When the next halving occurs, miner rewards will decrease from 6.25 to 3.125 bitcoins.

To maintain the Bitcoin blockchain, a decentralized network of miners verifies transactions through a process known as mining. Bitcoin miners are rewarded with newly minted BTC to incentivize their work. The reward, initially set at 50 BTC per block when Bitcoin was introduced in 2009, undergoes halving approximately every 210,000 blocks, shaping the overall supply. This systematic reduction is designed to infuse scarcity and impact Bitcoin’s supply.

Bitcoin’s unique deflationary supply schedule distinguishes it from other digital assets. The maximum supply is capped at 21 million BTC. Historically, Bitcoin’s halving has significantly influenced the asset’s price dynamics, contributing to its reputation as a store of value. The schedule of halving events is set to continue until the year 2140, when the block reward is estimated to reach zero, and the total supply of bitcoins will reach 21 million.

Analyzing historical data reveals a compelling correlation between Bitcoin’s price and halving events. Following the three previous halvings, Bitcoin’s value experienced significant upward trends. However, it is crucial to note that while the halving is a prominent factor, various external elements, such as monetary policies and market conditions, also contribute to Bitcoin’s price movements.

In April 2024, Bitcoin’s fourth halving will occur and there is heightened anticipation and interest in understanding how the reduction in supply will impact Bitcoin’s price trajectory and the digital asset market overall.

Trend #2: Digital Asset Indexes Construction Boom Continues

The digital assets index landscape is seeing a substantial increase in new products, which highlights a recognition of the appetite for index-based strategies within the ecosystem. As the industry matures, institutional investors are increasingly drawn to the structured and diversified exposure that indexes offer. Additionally, the complexity and diversity of financial mechanisms in the digital asset ecosystem, such as staking to generate yield and the rise of specific sectors (layer 2 protocols, GameFi, smart contracts), justify the need for indexes that capture a specific portion of the market.

As an example, in October 2023, Grayscale Investments partnered with FTSE Russell, the index division of the London Stock Exchange’s parent company, to introduce five new indexes that track digital asset sectors: Currencies; Smart Contract Platforms; Financials; Consumer and Culture; and Currencies Utilities and Services. This collaboration signifies a shift from the traditional focus on major crypto assets toward a more nuanced understanding of the evolving crypto landscape.

In 2024, more institutional market participants are likely to continue constructing digital assets indexes as their understanding of the various sectors and technologies advances.

Trend #3: A More Organized Cryptoverse

The digital asset market is becoming increasingly complex with every new emerging sector. A market that used to be dominated by Bitcoin and Ethereum has evolved into numerous verticals such as Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), Decentralized Physical Infrastructure Networks (DePIN), bridging protocols, liquid staking, layer 2 protocols, and many more.

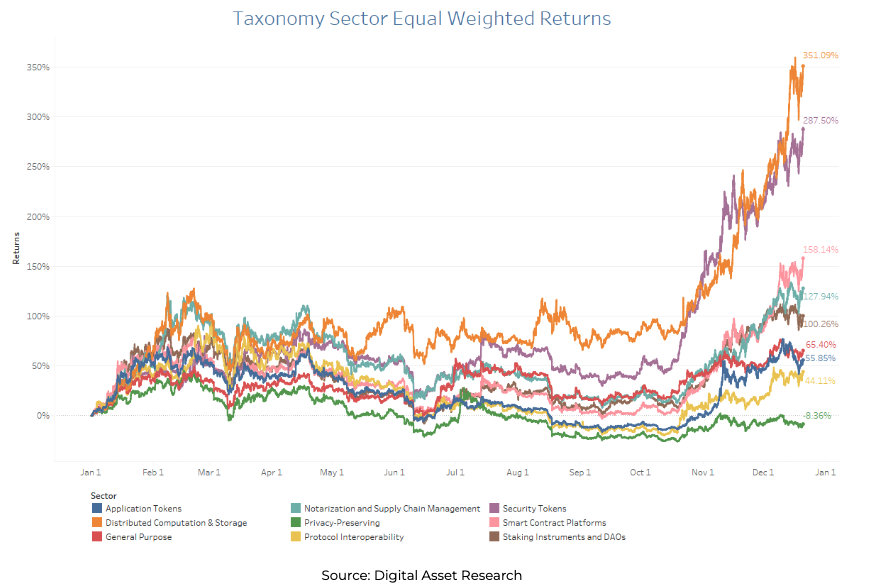

To better capture the nuance of the digital assets market, a proper classification methodology to map digital assets into different sectors is needed. For instance, the Digital Asset Taxonomy System (DATS) is a comprehensive framework that classifies over 1,700 digital assets based on their functionality or use case, including overarching themes and subthemes.

The chart below shows an example of a comparison of returns across DATS sectors in 2023. The Distributed Computation & Storage sector index was the best performer with a 351.09% increase, while the Privacy Preserving sector was the most significant laggard, generating a -9.36% decline.

Entering 2024, classification systems that organize the digital asset landscape and evolve as new trends emerge will be an essential tool for institutions looking to construct custom portfolios, evaluate performance across market sectors, issue index-linked products based on sectors, and more.

Trend #4: Real-World Asset Tokenization Continues

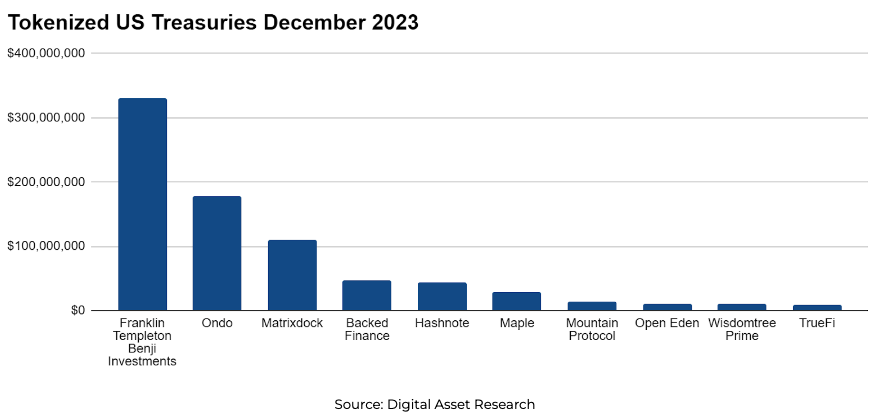

Real-World Assets (RWAs) are becoming an area of focus among institutional players and seeing an increase in total value locked within decentralized finance (DeFi) protocols. The tokenization of real-world assets involves the conversion of tangible and intangible assets, such as real estate, cars, collectibles, fine art, gold, and other items with inherent value, into digital assets that can be traded on a blockchain.

Over the past year, RWA tokenization providers have witnessed a surge in interest from firms from both inside and outside of the digital asset industry. Notably, the Avalanche Foundation invested $50 million to facilitate the integration of more tokenized RWAs. Traditional finance institutions including JP Morgan and Standard Chartered have also ventured into the space with their own asset tokenization programs. Furthermore, the Monetary Authority of Singapore launched a tokenization pilot program in November 2023.

U.S. Treasuries are the most notable asset that has been tokenized. As of December 2023, more than $780M of U.S. Treasuries has been tokenized by 12 providers, which was a significant increase over January 2023 which saw only ~$100M tokenized by 3 providers.

After the RWA tokenization landscape matured throughout 2023, the stage is set for increased provider diversity in 2024, with protocols offering investors access to tokenizing a broader spectrum of assets across different blockchains.

Trend #5: European ETPs Continue to See AUM Increases and Inflows

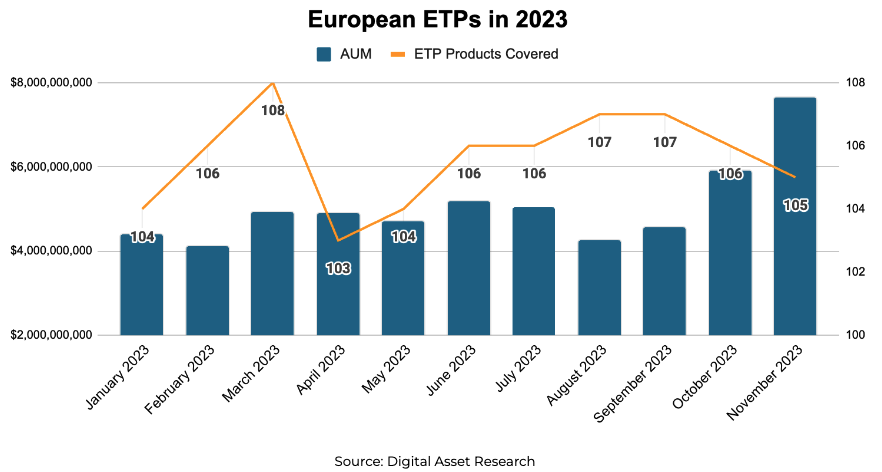

In 2023, European Exchange-Traded Products (ETPs) and Exchange-Traded Funds (ETFs) recorded assets under management (AUM) increases and inflows overall, reflecting sustained interest in digital asset investment products.

As of the end of November 2023, the total AUM for European ETPs reached ~$7.6B across 105 ETP products.

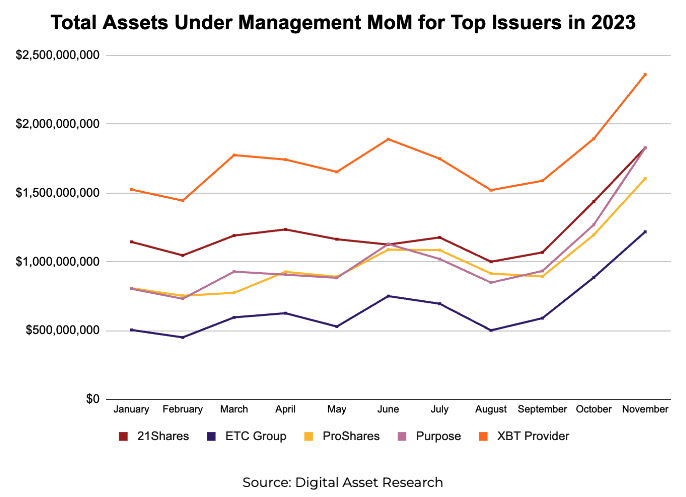

The ETP landscape also features a diverse set of issuers, with over 25 issuers having active products. Amongst this cohort, XBT Provider, 21Shares, Purpose, ProShares, and ETC Group captured the most AUM across their products as of the end of November 2023, as shown in the chart below which displays month-over-month (MoM) AUM changes.

In 2024, European ETPs may continue to see inflows as institutions continue to seek exposure to the maturing digital asset industry. The potential for the approval of a spot Bitcoin ETF in the U.S. by the SEC in Q1 2024 could further accelerate institutional adoption of crypto assets and lead to an increase in ETP market share across the $1.5T asset class.

Trend #6: Increasing Interest in Digital Asset ESG Research

As the digital assets industry continues to grow, conversations around the environmental, social, and governance (ESG) implications of these assets are starting to gain more attention. Although ESG is well understood for traditional assets, the sustainability of digital assets is a relatively unexplored topic.

Digital assets that are built on top of blockchain technology could be subject to ESG concerns such as:

- High energy consumption to facilitate blockchain transactions and mining.

- Illicit use of the technology due to limited regulation.

- A lack of transparency, especially among newer crypto projects.

Because of their unique nature, digital assets require a different assessment of ESG risks than traditional assets. FTSE Russell, an index provider, acknowledged in a recent interview that both ESG and the emerging digital asset space “require new degrees of risk assessment and rigor to create an appropriate index.”

| Environmental | Social | Governance | |

|---|---|---|---|

| Traditional Finance | Includes how a company protects or interacts with the environment and related policies | Includes how a company interacts with employees, suppliers, customers, and other stakeholders | Includes a company’s leadership, incentives, internal controls, audits, and shareholder rights |

| Crypto Assets | Includes the project’s environmental impact | Includes the strength and other aspects of the project’s communities | Includes the quality and durability of the token’s governance |

In 2024, ESG is expected to play a role as the industry continues to mature and investors look for assets aligned with their standards. Scoring systems – such as DAR’s which evaluates 90+ factors across E, S, and G, as well as a fourth “Network – N” pillar – will help institutions identify assets that match their investment profiles.

Trend #7: Faster Data Delivery

The importance of faster data delivery is paramount for the digital assets market due to its global, permissionless, and 24/7 nature. At any given moment, market participants can conduct transactions from anywhere in the world, which emphasizes the need for access to real-time data to make timely and informed decisions. Moreover, the digital assets market fluctuates rapidly and is known for its volatility. Whether an investor is looking to capitalize on market opportunities or seeking to manage risk, faster data ensures that participants can better adapt to market conditions. Additionally, the nature of blockchain as a railway for permissionless value and data transfer means that there is an abundance of data that can be accessed by any participant.

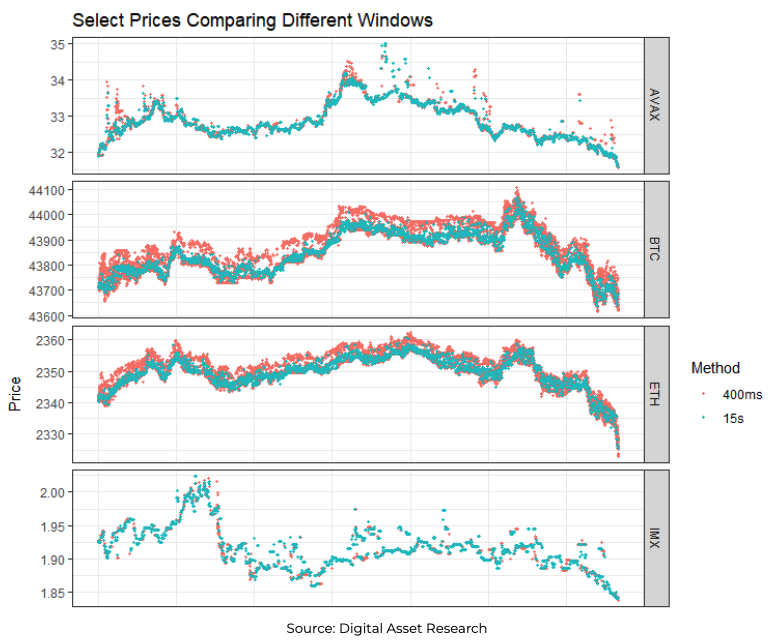

As digital asset markets continue to become more sophisticated in 2024, real-time price data will become even more important for some use cases because of its ability to capture price changes and volatility, as shown in the chart below which compares 15-second pricing to 400-millisecond pricing across a series of assets.

CONCLUSION

The digital assets market took significant steps forward in 2023 as it saw an increase in market capitalization, numerous spot Bitcoin ETF filings in the U.S., an increase in regulatory clarity across different jurisdictions, and signals that institutions are planning to enter the space.

In 2024, the digital asset industry is likely to continue to advance behind events like Bitcoin’s halving and the possibility of a spot Bitcoin ETF approval in the U.S. The continued evolution of the industry could also lead to trends like an increase in digital asset indexes, additional interest in digital asset taxonomy systems, more RWA tokenization, a focus on ESG for crypto assets, and a need for faster digital asset data.