DAR’s vetting processes bring institutional-level diligence to crypto markets and the latest vetting process results in 23 Vetted Exchanges, 17 Watchlist Exchanges, and 28 Benchmark Assets

New York, NY, July 13, 2021 – Digital Asset Research (DAR), a leading provider of crypto asset data and research, today announced the release of its July 2021 Crypto Exchange Vetting and Asset Vetting results. DAR’s vetting processes meet an industry-wide need for reliable crypto data by applying institutional-level diligence to digital asset markets in an environment where cryptocurrencies trade across hundreds of lightly regulated or unregulated exchanges.

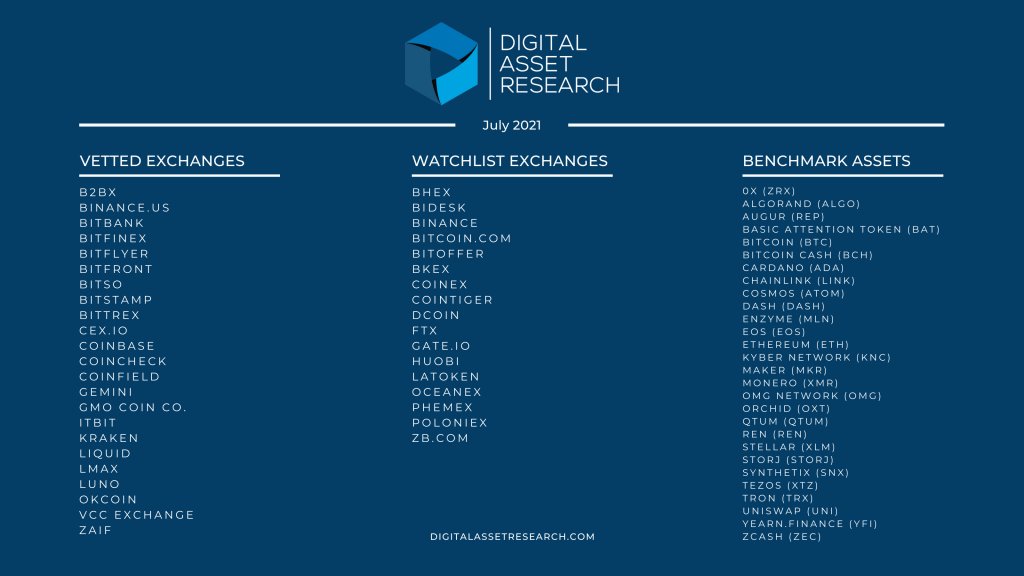

Over 450 exchanges were evaluated during the latest vetting process to identify 23 Vetted Exchanges. Four exchanges – B2BX, BITFRONT, CEX.IO, and CoinField – were added to the Vetted Exchanges list. Nineteen exchanges maintain their status as Vetted Exchanges: Binance.US; bitbank; Bitfinex; bitFlyer; Bitso; Bitstamp; Bittrex; Coinbase; Coincheck; Gemini; GMO Coin Co.; itBit; Kraken; Liquid; LMAX; Luno; Okcoin; VCC Exchange*; and Zaif.

Six exchanges were added as Watchlist Exchanges for potential future inclusion on the Vetted Exchanges list: Bidesk; Bitcoin.com; BitOffer; DCoin; FTX; and Phemex, while Bitrue was removed from the Watchlist due to not meeting quantitative diligence. Exchanges that continue to be on the Watchlist include Binance; BHEX (formerly HBTC); BKEX; CoinEx; CoinTiger; Gate.io; Huobi; LATOKEN; OceanEx; Poloniex; and ZB.com.

The Asset Vetting process evaluated over 1000 digital assets to identify 28 benchmark assets and over 600 non-benchmark assets. In the latest evaluation, Algorand (ALGO); Bitcoin Cash (BCH); Cosmos (ATOM); Enzyme (MLN); Maker (MKR); Storj (STORJ); Synthetix (SNX); Uniswap (UNI); and yearn.finance (YFI) were added to the Benchmark Asset list. The Benchmark Asset list also continues to include 0x (ZRX); Augur (REP); Basic Attention Token (BAT); Bitcoin (BTC); Cardano (ADA); ChainLink (LINK); Dash (DASH); EOS (EOS); Ethereum (ETH); Kyber Network (KNC); Monero (XMR); OMG Network (OMG); Orchid (OXT); REN (REN); Qtum (QTUM); Stellar (XLM); Tezos (XTZ); TRON (TRX); and Zcash (ZEC).

“The continued evolution of the crypto space is reflected in the results of our vetting processes. Crypto exchanges are working to mature their operations to meet institutional standards, which is evident in the growth of our Vetted Exchanges list, while the increase in the Benchmark Asset list is largely attributable to an expansion of asset listings on Vetted Exchanges,” said Doug Schwenk, CEO, Digital Asset Research (DAR).

The Exchange Vetting process combines quantitative and traditional qualitative due diligence to identify exchanges reporting accurate volumes and eliminate exchanges that are not appropriate for determining an accurate market price. During the Asset Vetting process, digital assets trading on Vetted Exchanges are evaluated to determine if they meet institutional investor standards for codebase construction and maintenance, community, security, liquidity, and regulatory compliance.

The results of the Exchange Vetting and Asset Vetting processes are used by DAR clients to determine accurate asset prices and to identify safe venues in the market. Results are also used for DAR Sector Indexes, the recently launched FTSE Bitcoin Index and FTSE Ethereum Index, and in the FTSE DAR Reference Price, a robust hourly reference price for digital asset market performance.

DAR performs its vetting processes quarterly. Results will next be announced in October 2021.

For further information, visit https://www.digitalassetresearch.com/.

*VCC Exchange remains on the Vetted Exchanges list, but has been placed on Enhanced Review due to a significant decrease in volume.

About DAR

Digital Asset Research (DAR) is a specialist provider of crypto data and research. Since 2017, DAR has combined its expertise in traditional financial services and the crypto space to meet the needs of institutional clients, including asset managers, banks, custodians, family offices, fintech firms, fund administrators, hedge funds, and venture capital firms; flagship clients include FTSE Russell, who DAR partners with to deliver FTSE DAR crypto asset reference prices and indexes. DAR’s core offerings include Clean Pricing & Verified Volume Data, a Crypto Events Calendar, a Reference Data Master, an Industry Taxonomy, Exchange Diligence, and Token Diligence, as well as related crypto market research.

Follow DAR

Twitter: @DAR_crypto

LinkedIn: https://www.linkedin.com/company/digital-asset-research/

Medium: https://medium.com/digitalassetresearch