DAR’s pricing methodology addresses crypto asset pricing problems to deliver institutional-quality digital asset prices

Modern digital assets have existed for a little over a decade. Bitcoin was created in 2009 after the Global Financial Crisis. In 2014, Ethereum pioneered the development of smart contracts, enabling the creation of decentralized applications. Despite those early developments, the true growth and emergence of digital assets as a new asset class did not occur until the 2017 bull market when the total digital asset market capitalization went above $800 billion.

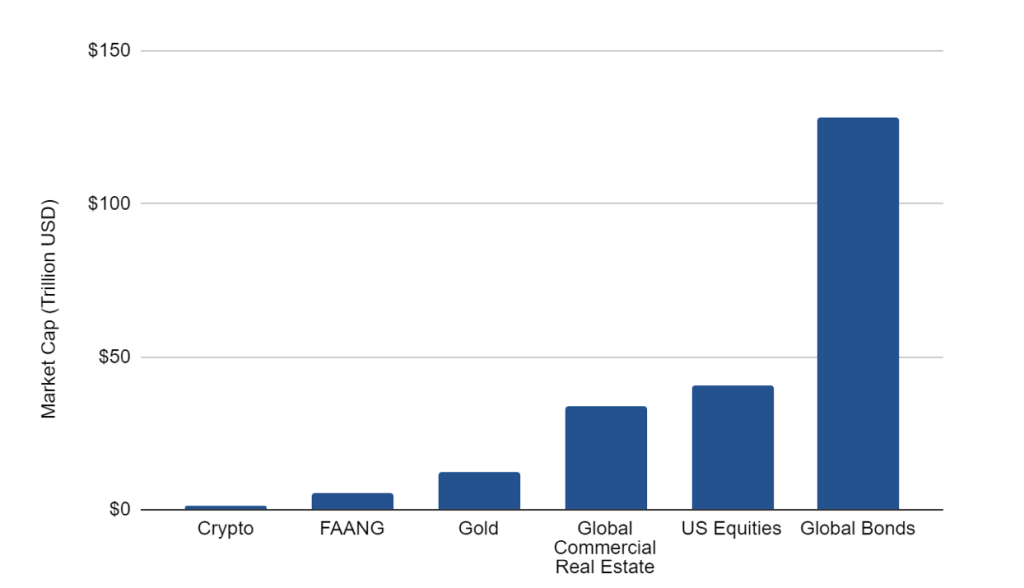

Even after a decade, crypto is still a nascent asset class. As of February 2023, crypto sits at ~$1.1 trillion in market capitalization, after reaching a peak of ~$3 trillion in 2021. By comparison, the combined market capitalization of the “FAANG” companies – Facebook (now Meta), Apple, Amazon, Netflix, and Google – is ~$5.3 trillion.

Source: Digital Asset Research, Google Finance, Statista, Siblis Research, ICMA

Crypto is also complex. It’s the only asset class that combines multidisciplinary fields with open-source principles. Anybody can create new digital assets and trade them 24/7, 365 days a year. These assets are also natively digital, which means that they are cross-jurisdictional in nature.

As a result, crypto markets are fragmented. There are hundreds of venues, with some regulated and others unregulated. There are venues that are managed via traditional business models, and there are also venues that are purely managed by code. These nuances have significant implications for crypto asset prices. In short, all crypto pricing is not the same.

In this piece, we take a deeper look at various factors that contribute to the quality of crypto asset prices, elaborate on their importance, and present a solution to this problem.

All Crypto Pricing Is Not the Same

The primary factors that make crypto markets fragmented are the number of venues the asset class can be traded on, the existence of decentralized exchanges (DEXs), and foreign exchange (FX) rate discrepancies across various jurisdictions.

Hundreds of Exchanges

Unlike U.S. equities, which have a central clearinghouse and a few major venues (like the NYSE and NASDAQ), crypto has hundreds of trading venues, each with its own markets, order matching engines, and settlement process. Even major commodities, like gold, only trade on approximately 40 exchanges globally.

In crypto, there are more than 600 crypto exchanges globally as of September 2022. Low barriers to entry mean that new exchanges are launched regularly. The codebase behind many matching engines is easily accessible and there are white-label services that allow ambitious entrepreneurs to start crypto exchanges.

The rules around starting a crypto exchange are also fairly ambiguous, especially in Emerging Markets (EMs). However, because of blockchain technology, crypto exchanges in EMs can easily access the same pool of capital and user base as exchanges in more regulated markets. Crypto market participants from around the world can easily use offshore exchanges, and they might be tempted to do so because of an exchange’s unique features.

Decentralized Exchanges

There are also decentralized applications that can power peer-to-peer transactions between market participants, creating what are known as decentralized exchanges (DEXs).

DEXs are fully managed by code and can run on their own via smart contracts on the blockchain. DEX users are not forced to complete any Know Your Customer (KYC) or Anti-Money Laundering (AML) processes and are able to conduct direct transactions “on-chain” without going through any centralized counterparties. DEXs began to emerge in mid-2020. Today there are hundreds of DEXs across multiple blockchain networks, further fragmenting crypto markets, which in turn affects the quality of crypto asset prices.

FX Rate Discrepancies

Additionally, as digital assets are traded globally, they are exposed to various FX rates. Crypto exchanges across the world are supporting trading pairs in their local currency, sometimes on top of USD-denominated pairs. This means that different capital control rules and the level of maturity of capital markets in different countries will affect crypto asset prices.

The most famous example of this is the price premium that Bitcoin has in South Korea, which is known as the “Kimchi Premium”. Bitcoin traded at a higher price in South Korea because of the country’s capital control rules, which limit cross-border flows of “hot” money.

Even recently, we are still seeing the Kimchi Premium phenomenon impact a high-demand asset. Aptos, a new Layer-1 blockchain valued at $4.5 billion that was founded by former employees of Meta’s now defunct stablecoin project, recently launched its APT token. DAR’s data shows that APT token prices on South Korean exchanges (like Korbit and Upbit) are considerably higher than US-based exchanges (like Binance.US and Coinbase).

Source: Digital Asset Research

Accurate Prices are Important

All the factors listed above contribute to the fragmentation of the crypto market. Therefore, liquidity becomes much more spread out than in traditional markets, especially for mid-cap and low-cap assets, causing discrepancies in crypto asset prices and their quality.

Institutions seeking an accurate price for crypto assets should consider the breadth and depth of their pricing sources and data set to ensure prices are representative of the larger market.

Why Crypto Asset Pricing Is Notoriously Unreliable

Free Aggregators and Misaligned Incentives

Many crypto market participants utilize free data aggregators as their primary resource for digital asset pricing. While this solution might be “good enough” for retail participants, institutional investors need to understand that there are significant differences between high-quality data providers and free aggregators.

Firstly, the incentives for free data aggregators are misaligned with maintaining the quality of the data. Free data aggregators generate the majority of their revenue via ad placements instead of from their data. They generally list as many assets as possible to ensure that they come up on top of search results to drive more traffic to their websites and increase ad revenue.

This business model offers no guarantee of data quality. The Block recently reported on a bug in CoinMarketCap’s data that showed the price of Bitcoin as $789 billion. As shown below, applications that are relying on this price data could have had significant issues, including potential impacts on end users’ capital:

“Some decentralized finance (DeFi) protocols also use CoinMarketCap as a source of price data. DeFi protocol DeFiChain tweeted, ‘Due to an error with the @CoinMarketCap API, all DeFiChain Vaults have automatically been halted for now, ensuring the safety of your loans.’ This implies that perhaps loans could have been liquidated based on the incorrect price data.” — The Block

Exchange Infrastructure

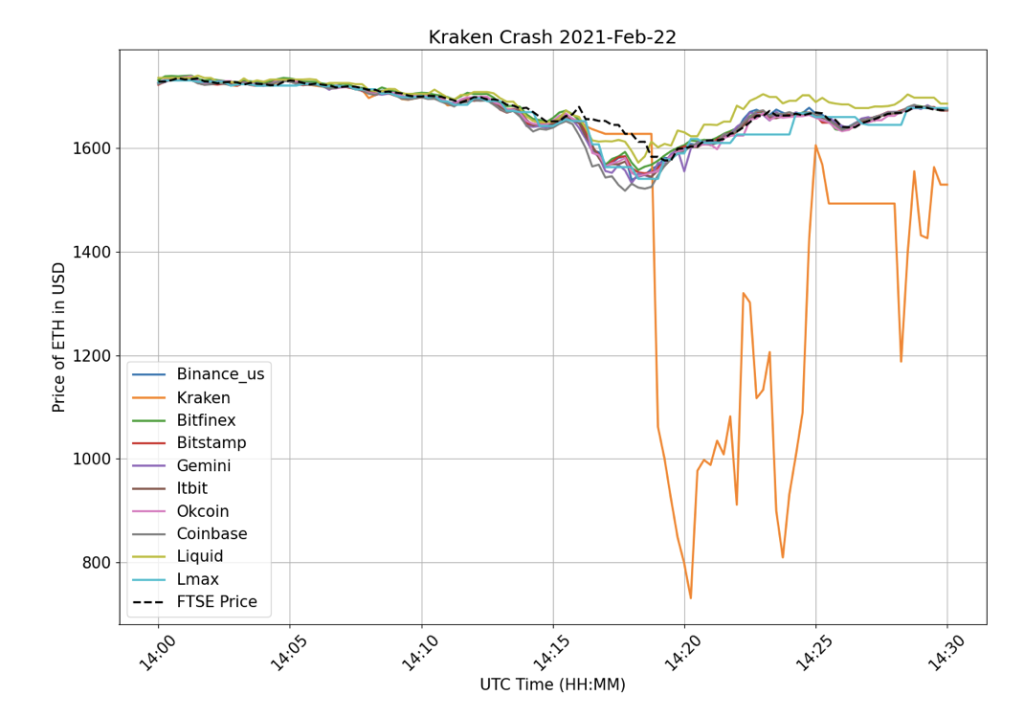

Crypto exchange infrastructure has also not always proven to be reliable. Even the most notable and well-capitalized exchanges have experienced problems that can have large consequences for market participants. For example, the price of Bitcoin on Binance.US had a flash crash on February 5, 2023, and dropped by over 25% to $17,020.33 momentarily. Such an event can cause substantial damage to market participants. Leveraged traders can get liquidated and investable index products relying on a bad price will be impacted. Kraken exchange also experienced a similar event in February 2021, when the price of ETH experienced a flash crash, deviating away from the broader market.

Source: Digital Asset Research

Unregulated Exchanges

The nascent nature of crypto markets and their globally distributed presence has also resulted in practices considered unacceptable or outright fraud in traditional markets. One well-known example is Quadriga, an exchange described as a fraud and a Ponzi scheme in a regulator’s report in the aftermath of losing $169M in client money.

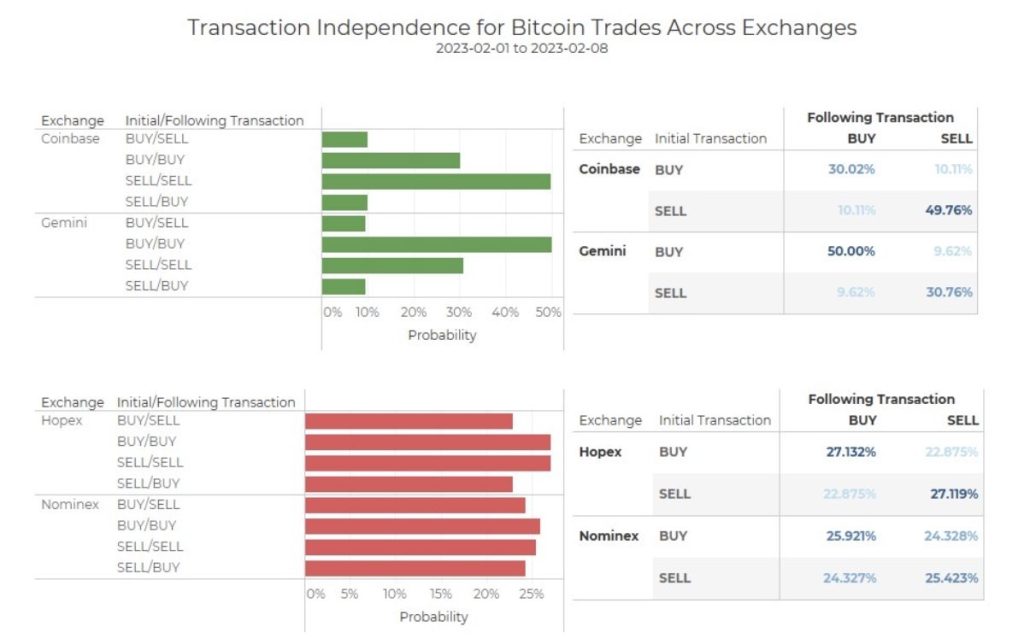

When reviewing an exchange’s validity as a source for crypto asset prices, one test that can be run to identify potential fraud is a review of buy-sell patterns within its order book. An exchange with fraudulent or manipulated activity may exhibit a “coin toss” pattern in its order book or a pattern that appears to be created by a random number generator, rather than a pattern more likely to be observed in orderly markets where trades are more closely aligned with market movement.

In the chart below, Bitcoin trades made in the first 7 days of February 2023 are compared across two DAR Vetted Exchanges and two centralized exchanges that did not pass vetting. The Vetted Exchanges exhibit the expected pattern where the previous transaction’s buy or sell direction typically indicates the direction of the subsequent transaction, which is what drives asset prices up or down. In contrast, the other exchanges in the comparison appear to follow a pattern that appears uniformly random meaning someone buying or selling Bitcoin is no more likely than a coin toss at any given moment..

Source: Digital Asset Research

Extreme Market Phenomena

Additionally, there are extreme market phenomena that can cause price discrepancies, even on assets with multi-billion dollar market capitalization. One recent example is the discrepancy in the price of TRX on the now defunct FTX exchange versus the broader market that occurred when the founder of TRX, Justin Sun, stated the following:

“We will do everything we can to protect our users, including exchange all #TRX, #BTT, #JST, #SUN, #HT on the FTX platform at a 1:1 ratio,” – Justin Sun

This statement caused the price of TRX on FTX to surge by more than 4,000%. Ensuring that one has a proper pricing data provider is crucial to understand what happens in the crypto market during extreme market phenomenon.

Source: Digital Asset Research

How DAR’s Data Solves This Problem

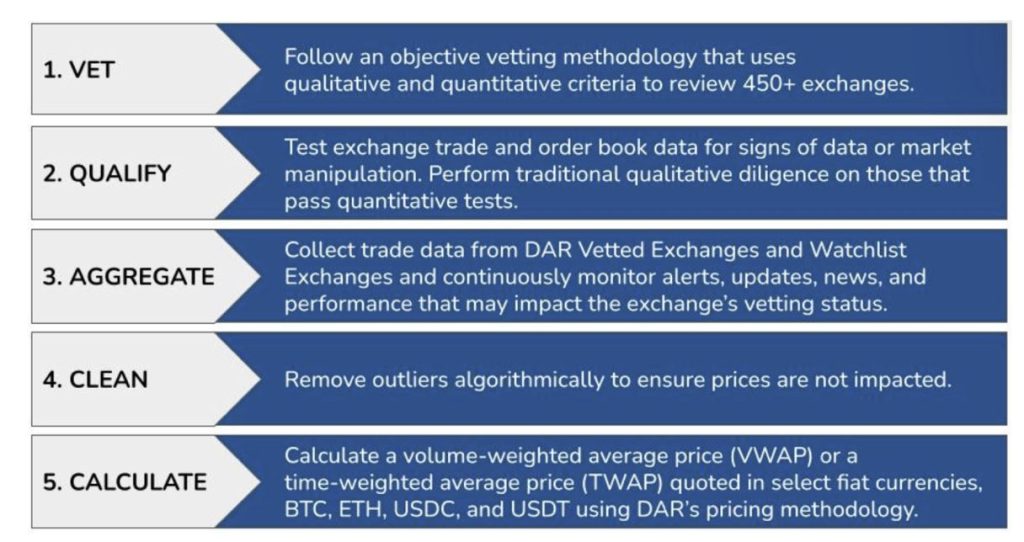

DAR’s pricing methodology solves many of the problems associated with crypto pricing by implementing thorough quantitative and qualitative diligence. To achieve this, DAR utilizes a five-step process to vet, qualify, aggregate, clean, and calculate digital asset prices.

Specifically, this process brings quality to crypto pricing data by vetting 450+ exchanges on a quarterly basis to currently qualify 18 Vetted Exchanges and 10 watchlist Exchanges. Only these exchanges are then utilized as pricing sources to calculate DAR’s 1,100+ ‘clean’ prices for digital assets.

Five Steps to DAR’s ‘Clean’ Prices

For institutional market participants, quality pricing data is critical, and there are numerous ways to utilize DAR’s clean prices. Use cases range from creating institutional-grade products (ETP, ETF) to calculating NAV and principal market prices for portfolio reporting to serving as a pricing oracle source for decentralized applications.

DAR’s customers have utilized quality pricing data for various use cases such as:

- Benchmark and Index Pricing

- Asset Pricing

- Oracle Pricing for Smart Contracts

- NAV Calculation

- Risk Management

As the crypto industry matures and further integrates with the broader financial system, the need for quality pricing data will continue to grow. DAR’s clean crypto asset prices ensure that institutional market participants will be equipped with high-quality data for their digital asset needs.

Book a consult with DAR to learn more or to request a sample of our Pricing Data vs Free Aggregators.