YOU ARE RESPONSIBLE FOR DETERMINING WHETHER ANYTHING CONTAINED HEREIN IS SUITABLE FOR YOUR PARTICULAR

CIRCUMSTANCES, AND FOR SEEKING PROFESSIONAL TAX, LEGAL, AND/OR INVESTMENT ADVICE AS APPROPRIATE. PLEASE SEE

THE OTHER DISCLAIMERS AT THE END OF THIS REPORT.

For a PDF version of this report, please click here.

INTRODUCTION

In a year filled with milestones, Bitcoin (BTC) is soon approaching another major event with the upcoming arrival of its next halving. Estimated for April 2024, the halving will impact Bitcoin’s supply, market structure, and more. Below, the purpose of Bitcoin’s halving is explored, the impact of previous halvings is reviewed, and changes the market may see due to the next halving are discussed.

WHAT IS THE BITCOIN HALVING?

As a core component of Bitcoin’s design, the halving is a scheduled recalibration of the rewards that are earned for mining the asset. As an asset that uses a Proof-of-Work consensus mechanism to reach an agreement on the state of its network, Bitcoin provides rewards to miners who generate new blocks. On the Bitcoin blockchain, after every 210,000 blocks are mined, or approximately every four years, there is a mechanism called the “halving” that reduces the creation of new Bitcoin by cutting the mining reward in half.

The halving is one of Bitcoin’s most distinctive features, with the precision and predictability of each halving event setting it apart from other crypto and traditional assets. Embedded firmly in Bitcoin’s blockchain code, the halving mechanism provides a clear, unalterable schedule for the future issuance of new Bitcoins. Bitcoin is scheduled to have 32 halving events in total, with the last one likely to occur in 2136, at which time the asset’s maximum supply of 21M BTC will be reached.

| Halving | Date | Block Reward Change |

|---|---|---|

| 1 | November 28, 2012 | 50 BTC to 25 BTC |

| 2 | July 9, 2016 | 25 BTC to 12.5 BTC |

| 3 | May 11, 2020 | 12.5 BTC to 6.25 BTC |

| 4 | April 2024 | 6.25 BTC to 3.125 BTC |

WHY IS BITCOIN’S HALVING IMPORTANT?

Since its creation in January 2009, Bitcoin has been the subject of many narratives, referred to at various times as an independent and decentralized answer to the traditional monetary system; the driver of a more transparent financial future; and as a store of value similar to “digital gold”, among other themes that have been assigned to the asset. Bitcoin’s halving mechanism can be seen to strengthen its position as a store of value asset like gold, as it increases supply scarcity, which when combined with its decentralized nature can appeal to those seeking a hedge against economic uncertainty.

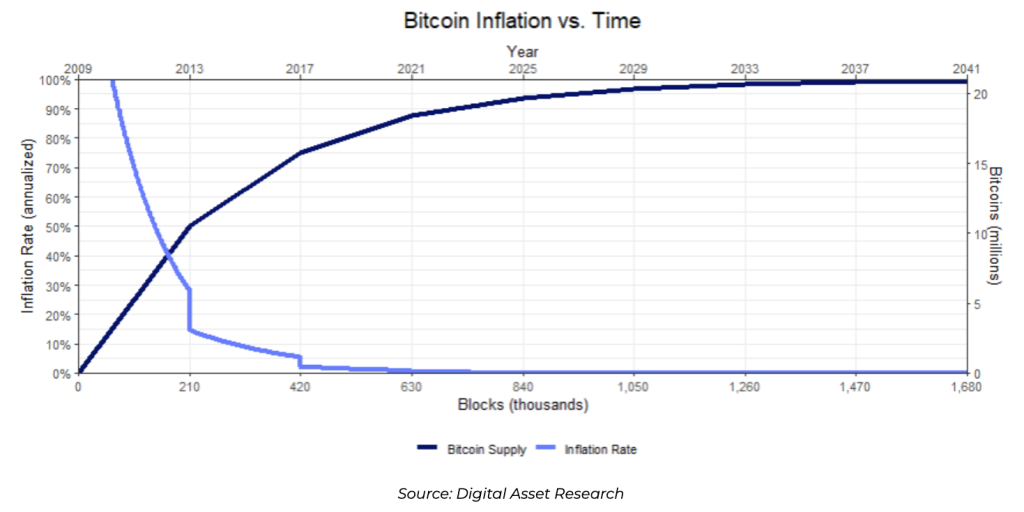

Economically, the reduction in the rewards rate associated with the halving introduces a deliberate scarcity, potentially impacting Bitcoin’s market value if demand is sustained or escalates. This deliberate slowing of supply growth is akin to an economic throttle, controlling inflation and mimicking the extraction of a finite resource. The chart below shows how Bitcoin’s inflation rate and supply change over time.

As the reward decreases, the scarcity of new Bitcoin creation can increase the asset’s perceived value, under the principle that a reduced supply coupled with steady or increasing demand leads to a price increase.

The transparent and predetermined reduction in the mining reward also instills a level of certainty of scarcity not matched by traditional assets. Unlike gold or other precious metals that are seen as store-of-value assets, Bitcoin’s supply curve is not subject to the unpredictability of new discoveries or technological advancements in extraction. While gold reserves can potentially be found and mined unexpectedly, flooding the market and impacting its value, Bitcoin’s issuance is strictly governed by its inalterable programming, ensuring that no such sudden increase in supply can occur.

The halving’s implications extend far beyond the token’s price as the network’s underlying model is also impacted. By reducing rewards given to miners, the halving exerts financial pressure on the mining community, which can particularly impact individual miners and smaller operations. For those in the mining business, halving events lead to a period of adjustment as miners seek to remain profitable under the new reward structure. Miners may seek greater efficiency and reduced operational costs by optimizing their hardware, known as mining rigs, but consolidation may also occur, potentially leading to a less secure and more centralized network. Since the computational power provided by miners is instrumental in safeguarding the network, a drop in mining profitability could make the network more vulnerable.

However, the Bitcoin ecosystem is designed with counterbalancing mechanisms. Ideally, as mining rewards diminish, the increasing scarcity of Bitcoin would drive its price up, maintaining or even enhancing mining profitability in fiat terms. This relationship between halving, price, and miner revenue is crucial; if the price fails to appreciate post-halving, miners might struggle to cover their operational costs, leading to a drop-off in mining activity and, consequently, a drop in the Bitcoin hashrate and network security.

Thus, Bitcoin’s halving mechanism and each halving event serve as not just a feature of the token’s economic strategy but also as a critical inflection point that shapes the future of the network’s security, operational dynamics, and, ultimately, its long-term viability.

THE IMPACT OF PREVIOUS HALVINGS

The April 2024 halving event will be Bitcoin’s fourth. Historically, Bitcoin halvings have served as pivotal landmarks, each event ushering in a new era of market dynamics, as described below.

First Halving

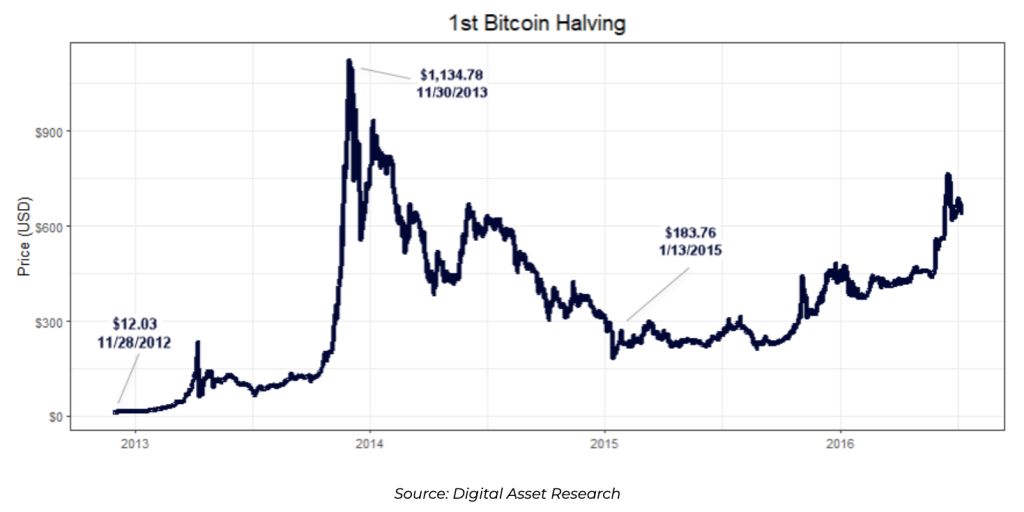

The first halving occurred on November 28, 2012, and reduced the reward for mining a block from 50 BTC to 25 BTC. At the time of this halving, BTC was priced at ~$12.20. This halving marked the beginning of Bitcoin’s deflationary reward supply and occurred early in the asset’s life cycle prior to its widespread recognition as an investable asset.

| 30 Days | 60 Days | 90 Days | 180 Days |

| 8.51% | 40.74% | 152.79% | 982.21% |

| 1 Year | 2 Years | 3 Years | 4 Years |

| 7872.96% | 2937.81% | 2892.27% | 6019.82% |

Following the first halving, Bitcoin’s price saw a peak of $1,134.78 on November 30, 2013, which was 367 days after the halving event. After that peak, Bitcoin’s price retraced to $183.76 on January 13, 2015, which was 409 days after reaching its peak.

Second Halving

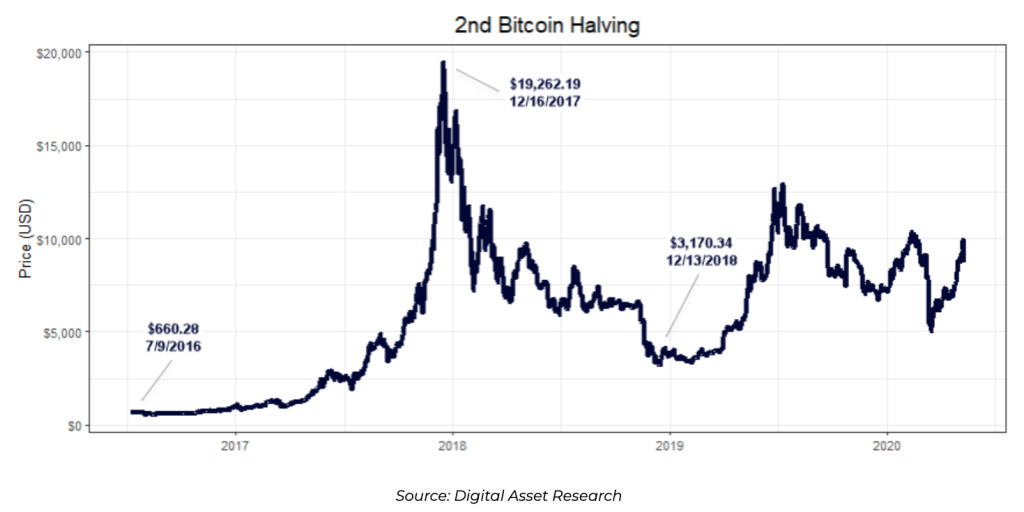

The second halving occurred on July 9, 2016 and reduced the reward for mining a block from 25 BTC to 12.5 BTC. Bitcoin was priced at ~$651 at the time of this halving and a period of significant price increases followed, drawing considerable attention to the asset’s investment potential and scarcity-driven value proposition.

| 30 Days | 60 Days | 90 Days | 180 Days |

| -13.05% | -10.39% | -8.61% | 64.48% |

| 1 Year | 2 Years | 3 Years | 4 Years |

| 282.59% | 921.41% | 1698.02% | 1303.91% |

Following the second halving, Bitcoin’s price saw a peak of $19,262.19 on December 16, 2017, which was 525 days after the halving event. After that peak, Bitcoin’s price retraced to $3,170.34 on December 13, 2018, which was 312 days after reaching its peak.

Third Halving

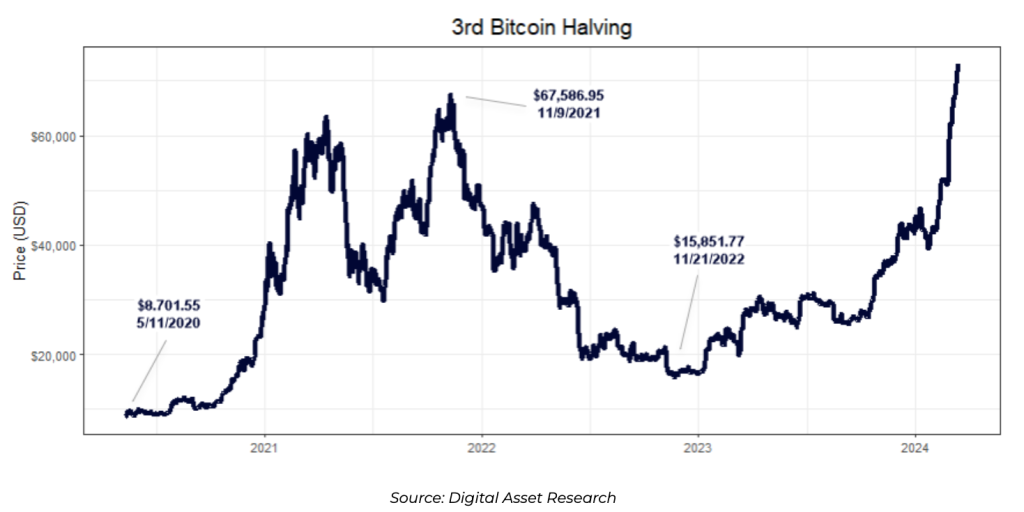

The third halving occurred on May 11, 2020 and reduced the reward for mining a block from 12.5 BTC to 6.25 BTC. Bitcoin’s price at the time of this halving was ~$8,821, a significant rise over the previous halving and a reflection of the asset’s growing stature.

| 30 Days | 60 Days | 90 Days | 180 Days |

| 11.60% | 7.87% | 34.42% | 78.67% |

| 1 Year | 2 Years | 3 Years | 4 Years |

| 566.89% | 260.36% | 218.17% | – |

Following the third halving, Bitcoin’s price saw a peak of $67,586.95 on November 9, 2021, which was 547 days after the halving event. After that peak, Bitcoin’s price retraced to $15,851.77 on November 21, 2022, which was 377 days after reaching its peak.

WHAT TO EXPECT WITH THE APRIL 2024 HALVING

Impact on Institutions and Markets

As Bitcoin approaches its fourth halving event in April 2024, digital asset markets are at a point of evolving regulatory clarity and increasing institutional adoption. On the regulatory side, governments and authorities globally continue to scrutinize digital assets while working to establish frameworks that ensure investor protection and compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) standards. This regulatory evolution has implications for the industry. Bitcoin has several factors that have positioned it uniquely against concerns, like its decentralized Proof-of-Work consensus mechanism, established track record as one of oldest digital assets, and the absence of a yield component.

Throughout early 2024, Bitcoin has seen increased institutional adoption, largely in part due to the U.S. Securities and Exchange Commission (SEC) approving spot ETFs in January 2024. These products not only enhance liquidity, but also integrate digital assets more closely with broader financial markets, signaling a maturation phase for the industry. ETFs and growing institutional acceptance may lead to an environment where digital assets play an increased role in the diversification and strategy of investment portfolios, further solidifying their position in the global financial architecture.

As of 1 March 2024, the 10 spot Bitcoin ETFs in the U.S. had over $48B in assets under management (AUM), with Grayscale’s GBTC leading with over $26B in AUM. From February to March, all of the spot Bitcoin ETFs saw an increase in their AUM, as detailed in the table below.

| Ticker | Name | AUM as of 1 March 2024 | Month-over-Month AUM Change |

|---|---|---|---|

| GBTC | Grayscale Bitcoin Trust ETF | $26,994,143,946 | 34.14% |

| IBIT | iShares Bitcoin Trust | $10,092,933,613 | 204.92% |

| FBTC | Fidelity Wise Origin Bitcoin Fund | $6,569,000,000 | 138.87% |

| ARKB | ARK 21Shares Bitcoin ETF | $2,178,110,000 | 203.78% |

| BITB | Bitwise Bitcoin ETF | $1,584,037,218 | 135.58% |

| BTCW | WisdomTree Bitcoin | $534,210,000 | 54.57% |

| BTCO | Invesco Galaxy Bitcoin ETF | $393,100,000 | 28.67% |

| HODL | VanEck Bitcoin Trust | $272,600,000 | 102.98% |

| BRRR | Valkyrie Bitcoin Fund | $194,394,639 | 70.07% |

| EZBC | Franklin Bitcoin ETF | $156,100,000 | 144.67% |

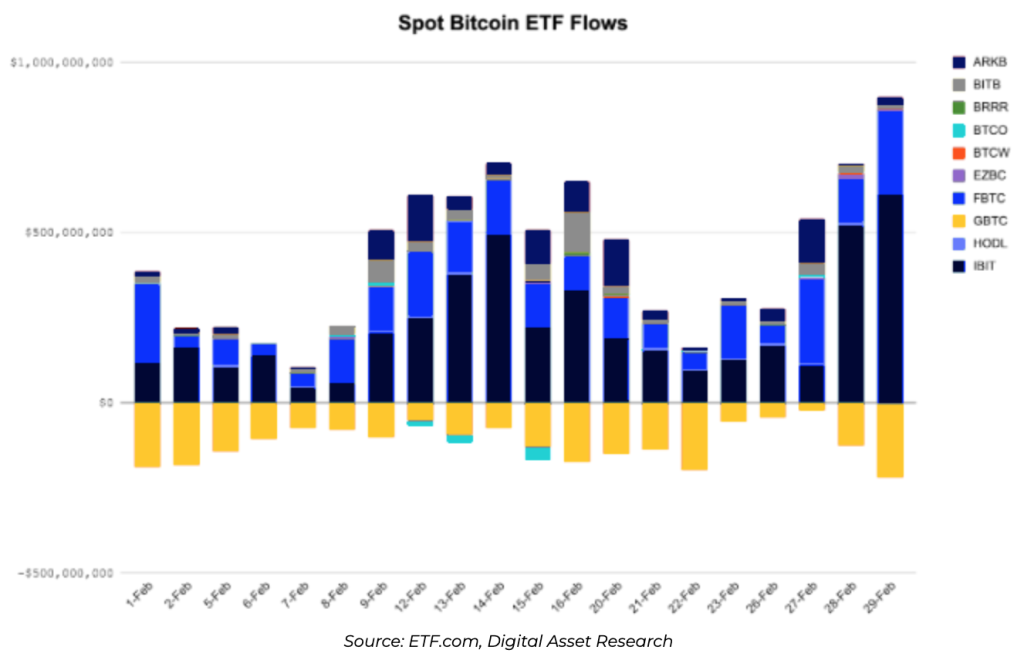

While price increases for Bitcoin have contributed to increases in AUM across the spot Bitcoin ETFs, there were also positive flows throughout February 2024, as shown in the chart below, which is another indicator of increasing adoption.

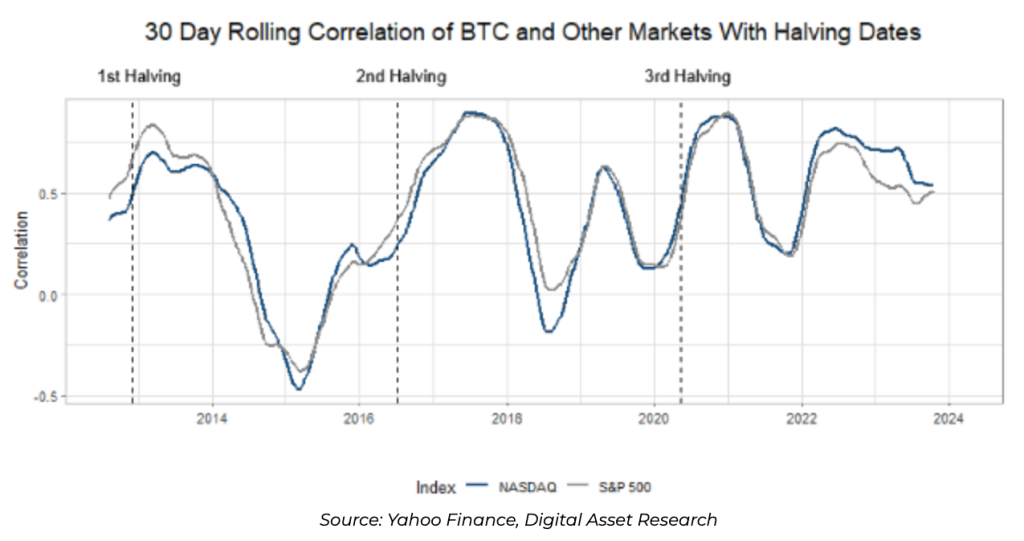

Previous halving events have seen Bitcoin’s price movements respond by increasing its correlation to markets like the S&P 500 and NASDAQ, as shown in the chart below. In the past, crypto markets have sometimes rallied when traditional markets have also increased in value, such as when interest rates were lowered in response to the COVID-19 pandemic. After the halving, it is possible that Bitcoin could again see its correlation to the S&P 500 and NASDAQ rise again, especially due to the increased integration with the traditional system through ETFs.

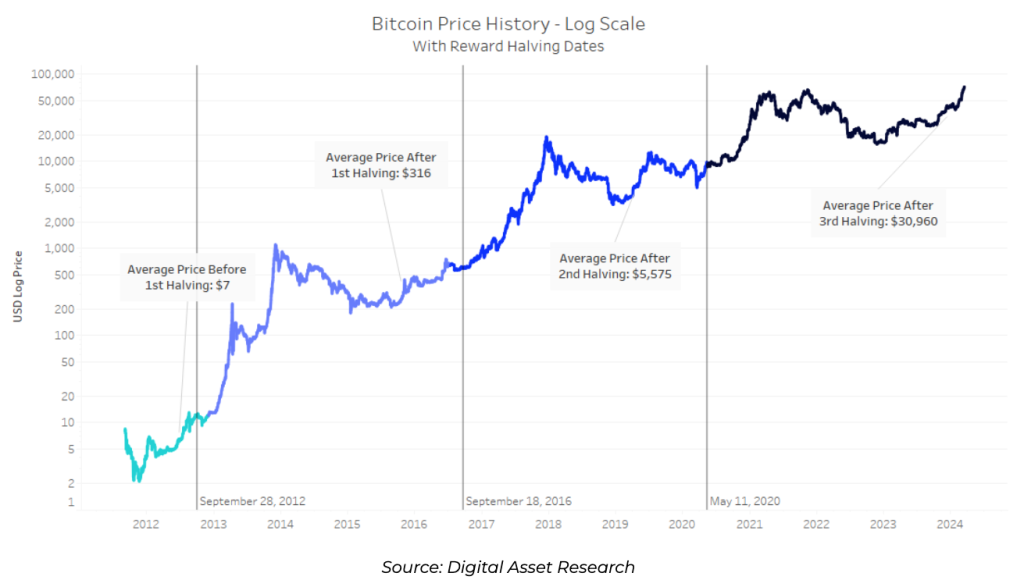

Following each previous halving event, Bitcoin has also seen its average price increase over the period preceding the next halving. Prior to the first halving, Bitcoin’s average price was ~$7; between the first halving and the second halving, Bitcoin’s average price was ~$316; between the second halving and the third halving, Bitcoin’s average price was ~$5,575; and after the third halving and through March 2024, Bitcoin’s average price was $30,960. While the upcoming halving’s impact is unknown, it is possible that this trend will continue.

Impact On Miners

The halving’s impact on miners will be a key area to watch after it occurs. The adjustment in miner revenue due to reduced rewards could lead to increased volatility, especially if the network’s computational power, or hashrate, fluctuates significantly. In the long run, if the price of Bitcoin does not appreciate to match the reduction in rewards, a decrease in miners could make the network more vulnerable to manipulation or attacks, such as a 51% attack, where an entity gains control of the majority of the network’s mining power and can manipulate the blockchain.

Even if Bitcoin’s price does not increase after the halving, there are some factors that could help to compensate miners for the reward reduction. Miners also earn transaction fees and if Bitcoin’s adoption continues to increase, then transaction volume and associated fees may also rise. The rise of the BRC-20 token standard could also lead to increased miner revenue. BRC-20 allows for the creation of fungible tokens on the Bitcoin blockchain using a method known as ordinal inscriptions and has introduced a new way to utilize the Bitcoin network beyond its original purpose as a peer-to-peer electronic cash system.

CONCLUSION

Bitcoin is approaching its next halving event, which will impact the asset itself, its community, and the broader digital asset market. Previous halvings have led to periods of price increases and a rise in Bitcoin’s correlation to traditional markets. This halving comes at a unique time, with Bitcoin seeing rising prices throughout early 2024 and increased institutional adoption due to the approval of spot Bitcoin ETFs in the U.S. Alongside potential price impacts, the halving’s effect on decreasing mining rewards will affect the Bitcoin mining ecosystem, which is a key area to watch as the network seeks to maintain decentralization and security.

DISCLAIMERS

You are permitted to store, display, analyze, modify, and print this report, but only for your own use. You are not permitted to (a) reverse engineer, decompile, decode, decrypt, disassemble, or in any way derive source code from this report; (b) modify, translate, adapt, alter, or create derivative works from this report; (c) copy (except as expressly permitted in the Subscription Services Agreement), distribute, publicly display, transmit, sell, rent, lease or otherwise exploit this report or grant any third party access to it; (d) frame or scrape or in-line link to this report or use web crawlers, web spiders or other automated means to access, copy, index, process and/or store any of the information herein; (e) create apps, extensions, programs or other products or services that use any of the information herein; or (f) make or have made a service or product using similar ideas, features, functions or graphics of or providing a similar benefit as that provided by this report.

DAR DOES NOT MAKE AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES, ORAL OR WRITTEN, EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF NON-INFRINGEMENT, MERCHANTABILITY, AND FITNESS FOR A PARTICULAR PURPOSE. WITHOUT LIMITING THE FOREGOING, YOU AGREE THAT YOUR USE OF THIS REPORT IS AT YOUR SOLE RISK AND ACKNOWLEDGE THAT THIS REPORT IS PROVIDED “AS-IS” AND DAR DOES NOT MAKE ANY WARRANTIES WITH RESPECT TO THE OPERATION, AVAILABILITY, RELIABILITY, ORIGINALITY OR ADEQUACY OF THE SAME. THIS REPORT (INCLUDING ANY INFERENCES OR CONCLUSIONS DRAWN HEREIN) IS BASED ON INFORMATION DAR CONSIDERS RELIABLE, HOWEVER, DAR DOES NOT REPRESENT IT AS ACCURATE OR COMPLETE, AND IT SHOULD NOT BE RELIED ON AS SUCH. THIS REPORT (INCLUDING ANY INFERENCES OR CONCLUSIONS DRAWN HEREIN) IS PROVIDED FOR GENERAL INFORMATIONAL PURPOSES ONLY AND YOU ARE RESPONSIBLE FOR DETERMINING WHETHER ANYTHING CONTAINED HEREIN IS SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES, AND FOR SEEKING PROFESSIONAL TAX AND/OR INVESTMENT ADVICE AS APPROPRIATE. DAR DOES NOT GIVE TAX, LEGAL OR INVESTMENT ADVICE OR ADVOCATE THE PURCHASE OR SALE OF ANY SECURITY, INVESTMENT, CRYPTOCURRENCY OR DIGITAL ASSET. NONE OF THE INFORMATION CONTAINED IN THIS REPORT CONSTITUTES OR IS INTENDED TO CONSTITUTE A RECOMMENDATION BY DAR TO ACQUIRE, HOLD, INVEST IN, OR USE ANY PARTICULAR COIN, TOKEN, CRYPTOCURRENCY, PROTOCOL, COMPANY OR FOUNDATION.

You assume the entire risk of any use you make or permit to be made from this report. Without limiting the foregoing and to the maximum extent permitted by applicable law, in no event shall DAR have any liability regarding this report for damages, even if notified of such possibility.

The information contained herein is as of the date hereof and is subject to change without prior notice. We may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Information containing any historical information, data or analysis should not be taken as an indication or guarantee of any future performance as past performance does not guarantee future results. None of DAR’s products or services recommend, endorse, or otherwise express any opinion regarding any “coin”, “token”, “cryptocurrency” “protocol”, “company” or “foundation” and none of DAR’s products or services are intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.